Down Payment Assistance Program opportunities are transforming the way people buy homes in the Seattle real estate market. If you’ve been struggling to save up for a hefty down payment, you’re not alone—and thankfully, you’re not out of options.

In today’s fast-moving and high-cost housing environment, a Down Payment Assistance Program can be the difference between continuing to rent and finally owning your own home. These programs are specifically designed to lower the biggest barrier most buyers face—upfront cash requirements.

As home prices continue to climb, particularly in the Seattle real estate market, more and more buyers are turning to Down Payment Assistance Programs as a practical, proven solution. Whether you’re a first-time buyer or re-entering the market after a few years away, these programs can provide the financial leverage you need to make a competitive offer and secure your next home.

Seattle may be known for its high housing prices, but that doesn’t mean homeownership is out of reach. With the right tools and a little guidance, buying a home here is still possible—and a Down Payment Assistance Program might be exactly what helps you bridge the gap.

What Are Down Payment Assistance Programs?

A Down Payment Assistance Program is a financial tool designed to help homebuyers overcome one of the biggest hurdles to homeownership—saving for the down payment and closing costs. With home prices in the Seattle real estate market frequently exceeding $800,000, the traditional 20% down payment can easily top $160,000. That’s a major barrier for many would-be buyers—but that’s exactly where these programs come in.

How It Works

Down Payment Assistance Programs offer grants, low-interest loans, or deferred-payment second mortgages to cover part—or sometimes all—of your required down payment and closing costs.

These programs are often:

- Income-based, designed for low- to moderate-income households

- Geographically targeted, with local and state-specific options for Seattle and Washington State

- First-time homebuyer friendly, typically defined as someone who hasn’t owned a home in the last three years

According to the Urban Institute, homeownership among first-time buyers could increase by more than 25% if more eligible buyers used these programs. Still, many buyers miss out simply because they don’t know they qualify.

And with the average benefit now totaling around $17,000 (Down Payment Resource), a Down Payment Assistance Program can significantly reduce the cash required to close on a home.

Why It Matters in Seattle

- Median Seattle home price (Q1 2024): ~$850,000

- 20% down payment = $170,000

- Typical DPA benefit = $17,000 or more

- Impact: Covers 10% or more of what you’d normally need to bring to the table

These programs are designed to make the upfront costs of buying a home more manageable—especially in a competitive, high-cost area like Seattle.

Why Down Payment Assistance Programs Are Growing in Seattle

Financial Assistance Programs are gaining traction nationwide—and for good reason. In cities like Seattle, where the cost of entry into the housing market can be overwhelming, these programs are playing a critical role in making homeownership accessible to more buyers.

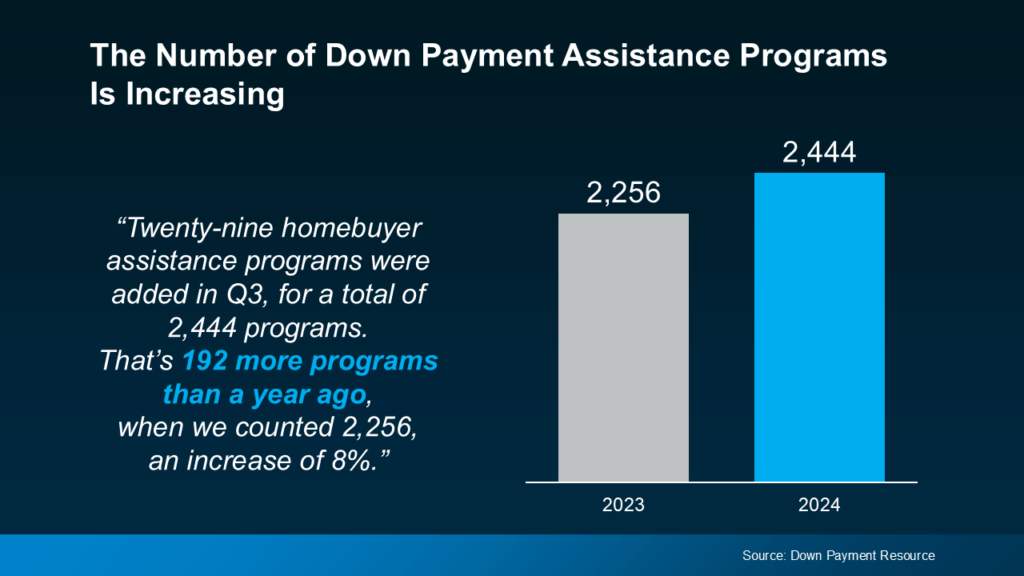

The total number of assistance programs in the U.S. increased to 2,444 in 2024, up from 2,256 in 2023—an 8% jump in just one year, as outlined in the Q3 2024 Homeownership Program Index Report by Down Payment Resource. That’s nearly 200 new programs added, many of which are designed to address affordability in high-cost urban markets.

Seattle is a prime example. With median home prices hovering around $850,000, saving for even a 10% down payment can mean setting aside $85,000—before accounting for closing costs, inspections, or moving expenses. Local programs offered through the Washington State Housing Finance Commission and Seattle Housing Authority are expanding to meet this challenge, targeting buyers who are financially stable but can’t reasonably save six figures while renting.

In a fast-growing region where wage growth hasn’t kept pace with housing prices, the rise in Affordable homeownership assistance is both necessary and timely. These resources can help you compete in the Seattle real estate market—and potentially purchase a home sooner than you thought possible.

Top Down Payment Assistance Programs in Washington State

If you’re buying a home in Seattle, there are several Housing assistance initiative designed specifically for our area. These programs are built to reduce your upfront costs and make homeownership more achievable—even in one of the most competitive housing markets in the country.

Here are the top local programs available to Seattle buyers right now:

Washington State Housing Finance Commission (WSHFC) – Home Advantage Program

This flagship statewide program is widely used by Seattle buyers. It offers a 0% interest loan to help cover your down payment and closing costs. The loan is payment-deferred until you sell, refinance, or pay off your mortgage.

- Must attend a WSHFC-approved homebuyer education course

- Available to first-time and repeat buyers

- Income limits apply and vary by household size and location

Learn more at the WSHFC Home Advantage Program page.

Washington State Housing Finance Commission – Opportunity DPA Program

This program is geared toward households earning less than 80% of Seattle’s Area Median Income (AMI). It offers up to $15,000 in assistance.

- Works alongside the WSHFC Home Advantage loan

- 1% simple interest, deferred payment

- Must meet income and purchase price limits

Program details are available through the Opportunity DPA Program overview.

Seattle Housing Authority (SHA) – First-Time Homebuyer Support

SHA provides assistance for low-income Seattle residents purchasing their first home. Assistance amounts vary and often include homebuyer education, financial counseling, and referrals to DPA resources.

- Must be an SHA program participant or meet income-based criteria

- Includes budgeting and credit repair support

- Can be used in conjunction with WSHFC loans

Check for eligibility and application details via the Seattle Housing Authority Homeownership page.

HomeSight Seattle – Down Payment Assistance and Second Mortgages

HomeSight is a Seattle-based nonprofit lender offering second mortgages and matched savings programs to support first-time and lower-income buyers.

- Offers up to $20,000 in assistance

- Can be layered with WSHFC programs

- Prioritizes community development and minority homeownership

Program info available at HomeSight’s homebuyer assistance page.

Employer-Sponsored Assistance (Check Your Benefits)

Some Seattle-area employers—especially large tech firms like Amazon, Microsoft, and Boeing—offer housing perks, including relocation bonuses, down payment grants, or homeownership assistance.

- Not publicly standardized—ask your HR rep

- Can sometimes be combined with public DPA programs

These programs are all available to buyers in the Seattle real estate market and can be used individually or in combination, depending on your qualifications. A single Down payment help may reduce your upfront costs by thousands—making a real difference in affordability.

Who Qualifies for Down Payment Assistance?

You may be closer to qualifying for a Down Payment Assistance Program than you think. Many Seattle-area homebuyers are surprised to learn they meet the requirements—often because eligibility is broader than expected.

While each program has its own criteria, here are the most common qualifications for Homebuyer assistance program available in the Seattle real estate market:

First-Time Homebuyer Status

Most programs define a first-time homebuyer as someone who hasn’t owned a home in the last three years. That means even if you’ve owned property in the past, you may still qualify today.

Income Limits

Many programs are designed for low- to moderate-income households. In Seattle, this often means earning up to 80% or 100% of the Area Median Income (AMI).

- For example, the WSHFC Opportunity Program is limited to households earning below 80% AMI.

- For a household of four in Seattle, that’s approximately $96,400 as of 2024 (HUD Income Limits).

Higher-earning buyers may still qualify for other programs or employer-based assistance.

Credit Score Requirements

Most programs require a minimum credit score of 620. Some may be more flexible with additional compensating factors like strong income or low debt.

Primary Residence Requirement

Homebuyer assistance program are intended for owner-occupants—not investors. The property must be your primary residence. Eligible property types often include:

- Single-family homes

- Condominiums

- Townhomes

- Manufactured homes (on owned land or approved leases)

- Multi-family homes (up to 4 units, if you live in one unit)

Additional Requirements

- Completion of an approved homebuyer education course (WSHFC or HUD-certified)

- Pre-approval with a participating lender

- Use of specific loan products (such as FHA, VA, or WSHFC-backed loans)

In the competitive Seattle real estate market, knowing whether you qualify for a Down Payment Assistance Program gives you a major advantage—and can expand your buying power considerably.

How Down Payment Assistance Helps Seattle Buyers

Buying a home in Seattle can feel like a financial stretch—but a well-matched Homebuyer assistance program can make that stretch manageable. These programs are designed to help buyers bridge the affordability gap, increase their buying power, and get a foothold in the Seattle real estate market without waiting years to save a six-figure down payment.

Bridge the Affordability Gap

With median home prices in Seattle hovering around $850,000, even a 5% down payment means coming up with over $40,000. An affordable homeownership assistance can reduce or eliminate this upfront hurdle, allowing you to enter the market faster.

Increase Your Buying Power

Reducing the cash needed for your down payment frees up money for other costs—closing expenses, moving, furnishings, or basic repairs. This flexibility allows you to shop confidently and act quickly when you find the right home.

Provide Long-Term Financial Stability

Buying a home helps you build equity instead of spending thousands on rent. With Seattle’s strong appreciation potential, even modest homes can grow in value over time, providing long-term financial benefits and stability.

3 Smart Strategies to Save for a Down Payment

Need help figuring out where your down payment will come from? In this short video, I share three effective strategies—some traditional, some creative—that Seattle buyers are using right now to fund their home purchases:

- 401(k) Loans and Withdrawals: We’ll look at when this makes sense (and when it doesn’t).

- Down Payment Assistance Programs: How to combine local programs with other funding sources.

- Gift Funds from Family: What you need to know about documentation and lender rules.

Affordable Housing Options in the Seattle Real Estate Market

It’s no secret that Seattle is one of the most expensive housing markets in the country—but that doesn’t mean affordable options don’t exist. If you’re open-minded about the type of home you buy and where you buy it, there are still viable pathways to homeownership. Better yet, many of these properties are eligible for a affordable homeownership assistance, helping you stretch your dollars further.

Manufactured Homes

Manufactured homes have come a long way in terms of quality, safety, and financing options. For buyers seeking a lower-cost entry point, they can offer serious value—especially when placed on owned land or within approved leasehold communities.

- The Washington State Housing Finance Commission allows affordable homeownership assistance funds to be used on manufactured homes, provided they are permanently affixed and meet lending criteria.

- In King County, the median price of a manufactured home was $285,000 in early 2024, compared to over $850,000 for a single-family home (Northwest MLS).

Multi-Family Properties (2–4 Units)

Seattle allows buyers to use certain Down Payment Assistance Programs when purchasing multi-family properties—as long as one unit will serve as your primary residence. These homes provide the added benefit of rental income to help offset your mortgage.

- FHA and some WSHFC programs permit up to four units.

- You may be able to qualify for a larger loan due to anticipated rental income from the additional units (HUD Handbook 4000.1).

This can be an excellent strategy for buyers who want to live affordably and build wealth over time.

Condominiums and Townhomes

Condos and townhomes remain some of the most accessible property types in the Seattle real estate market—especially in areas just outside the downtown core like Rainier Valley, Northgate, and West Seattle.

- As of Q1 2024, the median price for a condo in Seattle was $530,000, versus $885,000 for a detached home (Redfin).

- Many Down Payment Assistance Programs are fully compatible with FHA- or VA-approved condos.

Townhomes, often newer and built to modern codes, offer the feel of a single-family home but with lower price points and maintenance costs.

While the dream home in your ideal neighborhood may feel out of reach, the key is to expand your search criteria. With the help of a smart strategy—and the right Down Payment Assistance Program—you can get into a home that meets your needs, fits your budget, and positions you for long-term growth.

Best Neighborhoods for First-Time Buyers in Seattle

When entering the Seattle real estate market as a first-time buyer, the key is finding a neighborhood that balances affordability, livability, and long-term potential. Fortunately, several Seattle neighborhoods still offer opportunities that pair well with a Down Payment Assistance Program—especially if you’re open to condos, townhomes, or smaller single-family homes.

Here are four top areas to consider:

Beacon Hill

Known for its cultural diversity, light rail access, and beautiful views, Beacon Hill remains one of the more affordable single-family home areas south of downtown.

- Median home price: $717,000

- Easy transit access to downtown via the Link light rail

- Mix of housing types: single-family homes, condos, and newer townhomes

- Eligible for programs through WSHFC and HomeSight Seattle

Rainier Valley

Rainier Valley offers a wide range of price points and home styles, making it ideal for buyers using a Down Payment Assistance Program. The neighborhood also has one of the highest concentrations of community-based homebuyer resources in the city.

- Median home price: $790,000

- Includes neighborhoods like Columbia City, Hillman City, and Mount Baker

- Strong community support from organizations like Africatown, El Centro de la Raza, and HomeSight

- High transit connectivity and proximity to I-5 and I-90

Northgate

With a revitalized mall, new transit hub, and ongoing development, Northgate is becoming a hot spot for buyers seeking urban convenience without downtown prices.

- Median condo price: $450,000 – $550,000

- Located along the Link light rail’s Northgate extension

- Increasing inventory of new townhomes and FHA-eligible condos

- Still within WSHFC income limits for many properties

West Seattle

Offering a suburban feel, beach access, and a close-knit community, West Seattle is a great fit for first-time buyers who want a quieter lifestyle but still live within city limits.

- Median townhome price: $600,000 – $700,000

- Neighborhoods like Delridge, Highland Park, and South Park offer more budget-friendly options

- Served by WSHFC and other Seattle-area Down Payment Assistance Programs

These neighborhoods give you more than just affordability—they offer long-term value, walkability, and access to public services that enhance your quality of life. With the right Down Payment Assistance Program, getting into one of these communities may be closer than you think.

3 Steps to Qualify for Down Payment Assistance

Getting approved for a Down Payment Assistance Program in Seattle is easier when you understand the process. Whether you’re a first-time homebuyer or returning to the market, these three steps will help you take advantage of the programs designed to make homeownership more affordable.

Step 1: Attend a Homebuyer Education Class

Most Down Payment Assistance Programs in Seattle—such as those offered by the Washington State Housing Finance Commission (WSHFC) and HomeSight—require you to complete a certified homebuyer education course.

- These classes cover topics like budgeting, mortgage basics, and how to work with lenders and agents.

- They’re free, take about 5–6 hours, and are available online or in person.

- Completion is typically required before your loan can close.

You can find upcoming classes through the WSHFC education portal or through HomeSight’s education and counseling program, which is HUD-certified and based right here in Seattle.

Step 2: Speak with a Participating Loan Officer

Not all lenders work with Down Payment Assistance Programs, so it’s important to choose someone familiar with local requirements.

- Approved lenders will help you determine which programs you qualify for based on your income, credit score, and the type of property you’re purchasing.

- They can walk you through the application process and advise you on how DPA funds can be layered with different loan products.

- Some programs, like WSHFC’s, require you to use a lender from their approved list.

To get started, browse the WSHFC list of participating lenders or explore lending options through HomeSight.

Step 3: Work With a Local Real Estate Agent Who Understands DPA

In a fast-paced market like Seattle, working with a real estate agent who understands the timing, structure, and local requirements of Down Payment Assistance Programs is essential.

A knowledgeable agent can:

- Help you find homes that qualify for Seattle-based DPA programs

- Coordinate with your lender to ensure your financing and DPA timelines stay aligned

- Structure competitive offers that meet seller expectations without violating program conditions

- Guide you through inspections, appraisals, and program compliance through closing

The key to success is preparation—and I’m here to help.

If you’re ready to take the first step, I invite you to join me for one of my free January homebuyer classes, where we’ll walk through how to qualify for down payment assistance and create a plan to make your dream of homeownership a reality.

Why You Should Act Now

If you’re considering using a Down Payment Assistance Program to buy a home in Seattle, the time to start is now.

These programs are incredibly helpful—but they’re also limited. Most operate on a first-come, first-served basis, with finite funds allocated quarterly or annually. Once those funds are depleted, you may have to wait weeks or even months before they’re replenished.

Seattle’s real estate market is also highly competitive, especially in the spring and summer months. That means buyers who are already pre-approved and fully educated about their loan and assistance options have a significant edge.

According to the Down Payment Resource Q3 2024 Index, more than 2,400 assistance programs are currently active nationwide—but demand is growing rapidly, especially in expensive markets like ours.

Taking just a few steps now—like completing your education course, connecting with a participating lender, and understanding your options—can set you up to act quickly when the right home becomes available.

And remember, these programs are designed to help buyers just like you. You don’t need to have perfect credit or a huge income—you just need to be prepared, and that’s where I can help.

If you haven’t already, sign up for one of my free January classes, where I’ll walk you through the process step-by-step.

Conclusion: Let’s Make Your Homeownership Dream a Reality

Buying a home in Seattle doesn’t have to feel out of reach. With the rise of local Down Payment Assistance Programs, more buyers are entering the market with less cash upfront and more financial confidence.

These programs are designed to help everyday buyers—people with steady income and good credit, but not necessarily $100,000 in savings—secure a home, start building equity, and move toward long-term financial stability.

If this is your first time buying a home, you don’t have to figure it out on your own. I’m Emily Cressey with HomePro Associates, let’s chat—call me at (206) 578-3438 to get personalized guidance and clarity on what’s possible with a Down Payment Assistance Program. You can sign up here for one of my free January classes—we’ll go over the financing process, eligibility requirements, and how to compete in today’s market.

Check out our YouTube channel for home tours, local market updates, and home-buying advice tailored to Seattle buyers.