Retirement plan decisions often start with your home. As you look ahead to this next chapter of life, one of the most important questions to ask is whether your current home still aligns with your long-term goals.

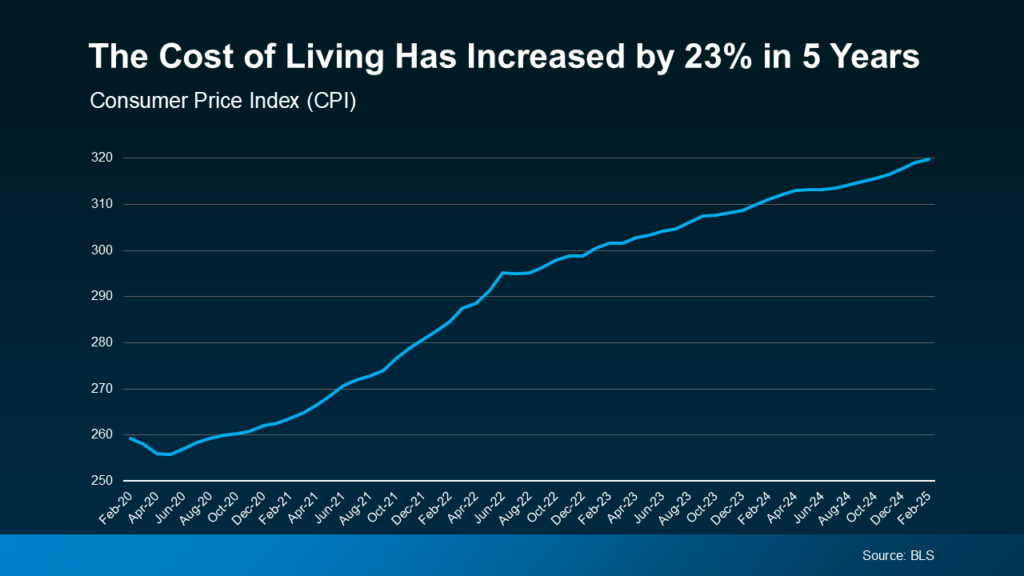

Here in Seattle, where the cost of living has surged by more than 23% over the past five years (according to the Bureau of Labor Statistics), the home that once worked perfectly for your family may no longer fit your lifestyle—or your budget. From rising expenses to evolving needs, your living situation plays a major role in shaping a successful retirement plan.

This isn’t just about finances. It’s about designing a lifestyle that brings comfort, freedom, and simplicity into your golden years. In this article, we’ll explore how to assess whether your Seattle-area home still supports your retirement plan, and what options might serve you better as you transition into retirement.

Assessing Your Current Home

Retirement plan alignment starts at home. The property that served you well during your working years may not be the one that carries you comfortably into retirement. Whether you’re still in your family home in North Seattle or settled into a craftsman in Ballard, it’s worth asking: Is this home helping or hindering your retirement lifestyle?

Your housing situation plays a major role in both your comfort and your financial flexibility. As living expenses continue to rise—Seattle included—it’s important to evaluate how your current home impacts your monthly budget, daily convenience, and long-term goals.

Key Questions to Consider

- Is the size of your home still appropriate? In the U.S., the average household size is shrinking, especially among retirees. Yet many older adults continue living in large, underutilized homes.

- Is your layout aging-friendly? More than 77% of adults aged 50+ prefer to age in place, but fewer than 1 in 10 homes are “aging-ready” with features like no-step entries, single-floor living, or wide doorways.

- Are maintenance needs manageable? Home maintenance costs average between 1–4% of the property’s value annually. In high-cost markets like Seattle, that can add up quickly—especially with older housing stock.

- Does your location still make sense? Proximity to healthcare, family, and social support networks becomes increasingly important in retirement. The Seattle area offers excellent access to medical care, but some neighborhoods are more walkable and age-friendly than others.

- What are your monthly costs telling you? Property taxes in King County continue to rise, with the median annual bill reaching $6,901 in 2023—up from $4,507 in 2016.

With inflation increasing the cost of essentials by over 23% from February 2020 to February 2025 (as shown in the Consumer Price Index data from the Bureau of Labor Statistics), many retirees are rethinking how their housing choices fit into their long-term retirement plan.

Sometimes, these answers lead to a clear conclusion: your current home still works. Other times, they reveal an opportunity to make a change—downsizing, relocating, or renovating—that better supports your health, finances, and future.

Should You Stay, Downsize, or Relocate?

Retirement plan decisions don’t stop with finances—they often begin with where you live. For many Seattle homeowners approaching or entering retirement, deciding whether to stay in their current home, downsize, or relocate altogether is one of the most pivotal choices they’ll make.

As living expenses continue to rise—up 23% from 2020 to 2025 according to the Consumer Price Index (CPI) published by the Bureau of Labor Statistics—retirees are finding that adjusting their housing situation can help protect their savings and unlock more financial freedom. That’s especially relevant in Seattle, where housing costs and property taxes remain well above the national average.

Option 1: Staying in Your Current Home

Staying put is often the path of least resistance, especially if your home is paid off, emotionally meaningful, and located in a walkable Seattle neighborhood. But the trade-offs are real:

- You may be carrying excess space that requires upkeep and heating.

- Property taxes in King County reached a median of $6,901 in 2023—up nearly 50% in the last seven years.

- Older homes, common in areas like Green Lake or Wallingford, may come with deferred maintenance or accessibility challenges.

If your current home aligns with your retirement plan—offering comfort, affordability, and convenience—it might still be the best choice. But for many, it’s worth comparing alternatives.

Option 2: Downsizing

Downsizing doesn’t have to mean sacrificing lifestyle—it can mean right-sizing for your next phase of life. Selling a larger Seattle home and moving into a smaller one in a nearby neighborhood like Shoreline, Bothell, or Edmonds can:

- Free up home equity to invest or supplement your retirement income

- Lower utility and maintenance costs

- Eliminate stairs or improve layout accessibility

- Reduce the emotional and physical workload of homeownership

As the original article from Simplifying the Market points out, many retirees choose to downsize and move to areas with a lower cost of living, allowing them to stretch their retirement dollars while focusing more on the things that matter—like travel, grandkids, or creative pursuits.

Option 3: Relocating (Near or Far)

Relocating—either out of Seattle or out of state—is a growing trend among retirees seeking affordability and better weather. In fact, according to GoBankingRates, “Where you choose to spend your golden years is critical” to how far your retirement savings will go.

That doesn’t always mean a dramatic move. Sometimes shifting from Seattle proper to suburbs with lower property taxes—like Kenmore or Lynnwood—can make a significant impact. In other cases, retirees choose to head out of Washington entirely for more tax-friendly states like Arizona, Idaho, or Oregon.

How Housing Decisions Can Unlock Retirement Lifestyle Goals

Retirement plan success isn’t just about financial savings—it’s about aligning your living situation with your desired lifestyle. For many Seattle-area retirees, reevaluating housing choices can lead to enhanced freedom, reduced expenses, and a more fulfilling retirement.

While some retirees choose to stay in their long-time homes, others find that downsizing or relocating better suits their evolving needs. Factors such as proximity to family, healthcare access, and cost of living play significant roles in these decisions.

Benefits of the Right Housing Move:

- Increased Financial Flexibility: Downsizing can free up home equity, reduce maintenance costs, and lower property taxes, providing more funds for travel, hobbies, or healthcare.

- Enhanced Accessibility: Moving to a single-level home or a community with senior-friendly amenities can improve daily living and safety.

- Closer to Loved Ones: Relocating to be near family can provide emotional support and assistance as needed.

According to the National Association of Realtors 2024 Migration Trends Report, 30% of movers cited proximity to family and friends as their primary reason for relocating, while 21% moved to get more home for their money. These statistics highlight the importance of both emotional and financial considerations in retirement housing decisions.

Moreover, a 2024 study by HireAHelper found that 13% of retirees who moved in 2024 did so for health-related reasons, emphasizing the need for accessible living environments.

In Seattle, where housing costs and living expenses are notably high, evaluating your current home’s alignment with your retirement goals is crucial. Whether it’s downsizing to a more manageable property in a nearby suburb or relocating to a region with a lower cost of living, making informed housing decisions can significantly impact your retirement satisfaction.

Section 4: Work with a Real Estate Expert Who Understands Retirement Transitions

A well-executed retirement plan includes the right people on your team—and that starts with a real estate expert who understands your goals. When you’re making one of the biggest financial and lifestyle decisions of your retirement years, you need more than a transaction—you need guidance, strategy, and trusted advice.

Navigating housing decisions in retirement isn’t just about choosing a smaller home or relocating to a new ZIP code. It involves timing, equity management, tax considerations, and emotional readiness. The right real estate agent will help you:

- Assess your current home’s market value and equity

- Identify downsizing opportunities that preserve lifestyle

- Coordinate repairs, staging, or renovations to maximize resale value

- Connect you with lenders, 1031 exchange advisors, or estate planners if needed

- Match you with trusted agents if you’re relocating out of the Seattle area

If you’re like many homeowners nearing retirement, you’re probably asking: “Should I sell now, wait, or stay?” Those are big questions—and you shouldn’t have to answer them alone.

According to the National Association of Realtors 2023 Profile of Home Buyers and Sellers, 89% of home sellers used a real estate agent, and the vast majority said their agent provided valuable advice on pricing, marketing, and timing the sale—all crucial factors in a successful retirement transition.

A seasoned local agent who understands both the emotional side of moving and the financial implications of retirement housing can make all the difference. That’s especially true in the Seattle market, where understanding pricing trends, neighborhood dynamics, and long-term investment value is key.

As your trusted real estate advisor, I help clients plan strategically—not just reactively. Whether you’re downsizing in North Seattle, relocating to a quieter suburb, or exploring multi-generational housing, I’ll make sure your next move aligns with your long-term retirement plan.

Conclusion: Make Your Home Work for Your Retirement Plan

A successful retirement plan isn’t just about numbers—it’s about lifestyle, freedom, and peace of mind. And that starts with where you live.

Whether you’re realizing your current home no longer fits your long-term goals, or you’re simply exploring what options are available to help stretch your savings further, the most important step is to be proactive. With living expenses rising—including a 23% jump in the cost of living over the past five years —there’s never been a better time to evaluate whether your home still supports the lifestyle you envision for retirement.

And remember, this process doesn’t have to feel overwhelming. With the right guidance, you can clarify your priorities, explore the possibilities, and create a transition plan that feels both smart and empowering.

Let’s Make a Plan Together

I’m Emily Cressey with HomePro Associates, and I specialize in helping Seattle-area homeowners make confident real estate decisions that support their life goals—especially during big transitions like retirement. Whether you’re downsizing, relocating, or just exploring your options, I’m here to help you evaluate your home, understand your equity, and align your next steps with your retirement plan.

📞 Call me at (206) 578-3438 to schedule a no-obligation consultation.

▶️ Want more expert insights on the Seattle housing market?

Subscribe to our YouTube channel for home tours, local market updates, and smart real estate tips—or visit HomeProAssociates.com to explore current listings and resources.