When it comes to buying or refinancing a home in Seattle, one of the nation’s most dynamic real estate markets, finding the right financing solution can make all the difference. Whether you’re purchasing a luxury property that requires a jumbo loan, need a bridge loan to transition smoothly between homes, or are considering a HELOC to tap into your home’s equity, understanding your options is key to making confident decisions.

Seattle’s competitive housing market demands financial strategies tailored to your unique needs and goals. In this article, we’ll break down popular financing options, explain how they work, and help you determine which solution fits your situation best. Whether you’re a first-time buyer, upgrading to your dream home, or managing an investment property, this guide has you covered.

Let’s dive in and explore how jumbo loans, bridge loans, and other creative financing options can help you navigate Seattle’s ever-changing real estate landscape!

Traditional Mortgages

A traditional mortgage, often referred to as a conventional loan, is one of the most common and straightforward financing options for homebuyers in Seattle. This type of loan is not backed by a government agency like the FHA or VA but instead follows the guidelines set by Fannie Mae and Freddie Mac. Conventional loans typically come in two forms: conforming loans, which adhere to the loan limits set by the Federal Housing Finance Agency (FHFA), and non-conforming loans, such as jumbo loans, which exceed these limits. With fixed or adjustable-rate options, traditional mortgages are versatile and cater to a wide range of buyers, from first-time homeowners to those upgrading to larger properties. In Seattle, where home prices are often high, the local conforming loan limit (around $977,500 in 2025) accommodates many properties, making conventional loans a popular choice.

What makes traditional mortgages appealing is their predictability and competitive terms for qualified buyers. Fixed-rate loans offer stability with consistent monthly payments, ideal for those planning to stay in their home long-term. Buyers with strong credit scores and sufficient down payments can benefit from lower interest rates and potentially avoid private mortgage insurance (PMI) if they put down at least 20%. In Seattle’s competitive market, these loans are particularly advantageous for those looking for a straightforward financing option to secure a single-family home, condo, or townhouse. While conventional loans require higher credit scores and stricter income-to-debt ratios than some government-backed programs, they remain a go-to solution for financially stable buyers seeking flexibility and reliability.

FHA Loans

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration, designed to make homeownership more accessible, particularly for first-time buyers or those with lower credit scores. FHA loans are popular in Seattle’s competitive housing market because they offer more flexible qualification requirements than conventional loans. Buyers can secure an FHA loan with a down payment as low as 3.5%, making it an attractive option for those with limited savings. Additionally, FHA loans are often available to borrowers with credit scores as low as 580, though some lenders may accept scores slightly lower. These features provide a valuable pathway to homeownership in a city where home prices can be a barrier for many.

However, FHA loans come with specific requirements and costs that buyers should consider. Borrowers are required to pay mortgage insurance premiums (MIP), which include both an upfront fee and monthly payments, to protect lenders in case of default. While the loan limits for FHA financing in Seattle are higher than the national average due to the area’s high housing costs, they may not be sufficient for luxury or higher-priced properties. Despite these limitations, FHA loans remain a practical option for buyers who need more lenient terms, especially in Seattle neighborhoods with more affordable housing options, such as parts of South Seattle or outlying suburbs. For many buyers, FHA loans are a stepping stone to building equity and achieving long-term financial stability in a competitive market.

VA Loans

A VA loan is a mortgage option backed by the U.S. Department of Veterans Affairs, designed to help active-duty military members, veterans, and their families achieve homeownership. One of the most significant advantages of a VA loan is that it requires no down payment, making it an excellent option in high-cost markets like Seattle, where saving for a traditional down payment can be a challenge. Additionally, VA loans do not require private mortgage insurance (PMI), which further reduces monthly costs compared to other loan types. Borrowers also benefit from competitive interest rates and flexible credit requirements, making VA loans one of the most affordable and accessible mortgage options for those who have served in the military.

Seattle’s proximity to military bases like Joint Base Lewis-McChord makes VA loans a popular choice for eligible homebuyers in the region. These loans can be used to purchase primary residences, including single-family homes, townhouses, and condos that meet VA standards. While there is no official loan limit for VA loans, lenders may impose limits based on local property values and a borrower’s entitlement. However, these limits are typically generous enough to accommodate many homes in Seattle’s real estate market. With its favorable terms and benefits, a VA loan is a powerful tool for military families looking to secure a home in Seattle and establish roots in this vibrant and thriving city.

Jumbo Loans

A jumbo loan is a type of mortgage designed for properties that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). In high-cost markets like Seattle, where the conforming loan limit is approximately $977,500 in 2025, many buyers turn to jumbo loans to finance luxury homes or high-value properties. Unlike conventional loans, jumbo loans are not backed by Fannie Mae or Freddie Mac, meaning lenders take on more risk and often require stricter qualification standards. Borrowers typically need a higher credit score, a larger down payment (commonly 10–20%), and sufficient cash reserves to qualify for this type of financing. These loans are essential for Seattle buyers navigating the city’s competitive market, especially in neighborhoods like Queen Anne, Capitol Hill, or Medina, where home prices frequently exceed conforming limits.

One of the key advantages of a jumbo loan is that it allows buyers to finance high-end properties without the need to split the financing into multiple loans. However, these loans often come with slightly higher interest rates compared to conforming loans, reflecting the increased risk to lenders. Jumbo loans can also require more detailed documentation of income and assets, ensuring borrowers have the financial strength to handle the larger loan amount. For Seattle buyers seeking to purchase a home that aligns with the city’s premium real estate market, a jumbo loan offers a tailored solution to access the necessary funds while still benefiting from competitive mortgage options.

Bridge Loans

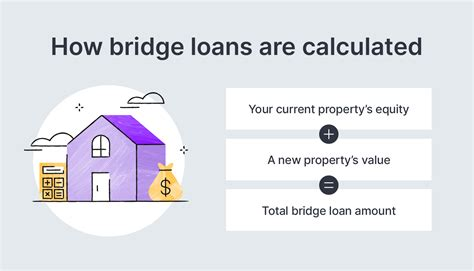

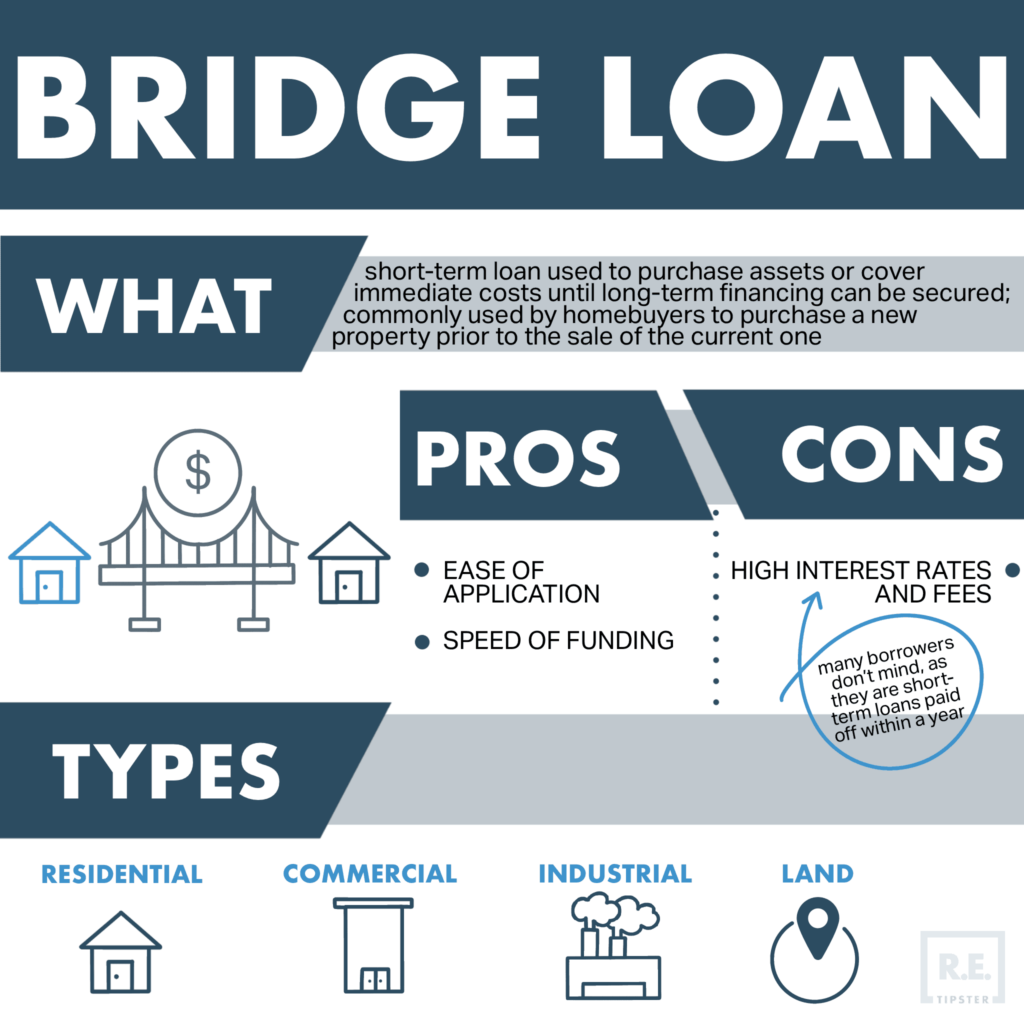

A bridge loan is a short-term financing option designed to help homeowners transition between selling their current home and purchasing a new one. These loans provide quick access to funds, typically secured by the borrower’s existing property, and are ideal for situations where timing is critical, such as Seattle’s competitive real estate market. With loan terms usually ranging from 6 to 12 months and interest rates between 6% and 9%, bridge loans enable buyers to make non-contingent offers on new properties without waiting for their current home to sell. This flexibility is especially valuable in a market where homes sell quickly, but higher interest rates and shorter repayment periods require careful planning.

Bridge loans are most useful for homeowners with significant equity in their current property and a clear plan to repay the loan, typically through the sale of their existing home. While they allow for seamless transitions, borrowers should be prepared for balloon payments at the end of the term and ensure their financial situation supports the additional debt. In Seattle, bridge loans offer a powerful tool for navigating the fast-paced housing market, making them a practical solution for buyers needing immediate liquidity to secure their next home. However, understanding the costs and risks involved is essential to determine if this option aligns with your goals.

HELOCs

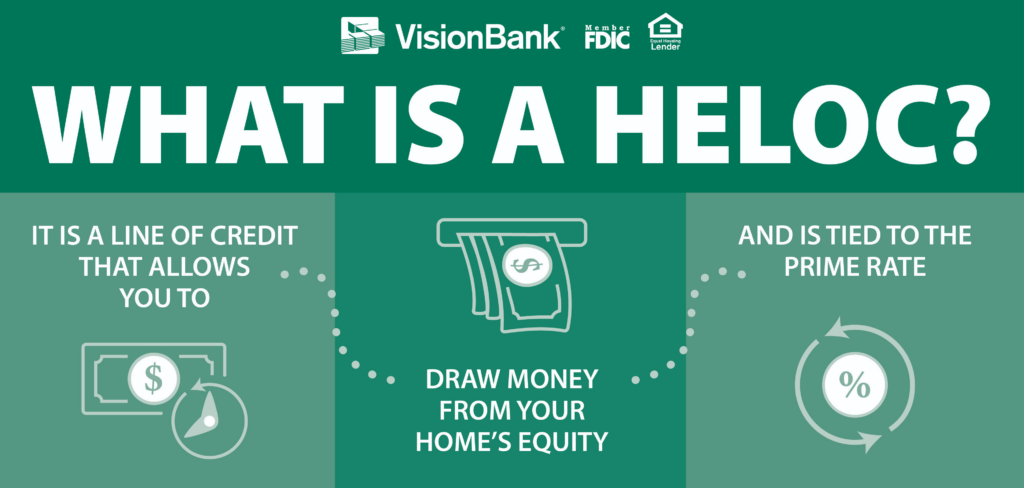

A Home Equity Line of Credit (HELOC) is a flexible financial tool that allows homeowners to borrow against the equity in their home. Functioning like a credit card, a HELOC provides a revolving line of credit that you can draw from as needed, often with a variable interest rate. It’s commonly used for home improvements, consolidating debt, or funding major expenses. In a market like Seattle, where home values have appreciated significantly, many homeowners find HELOCs an attractive way to access funds while leveraging their home’s increased equity. However, HELOCs require careful planning, as they use your home as collateral, and changes in interest rates can impact monthly payments.

Seattle homeowners considering a HELOC should evaluate both the benefits and potential risks. On the positive side, HELOCs offer lower interest rates than many other loan types and provide flexibility in how and when you use the funds. However, variable rates mean payments can increase over time, and failure to repay can result in foreclosure. With Seattle’s competitive real estate market and rising home values, HELOCs are a practical option for those who need financial flexibility, but it’s essential to consult with a trusted financial advisor or lender to determine if this option aligns with your financial goals.

Adjustable-Rate Mortgage (ARM)

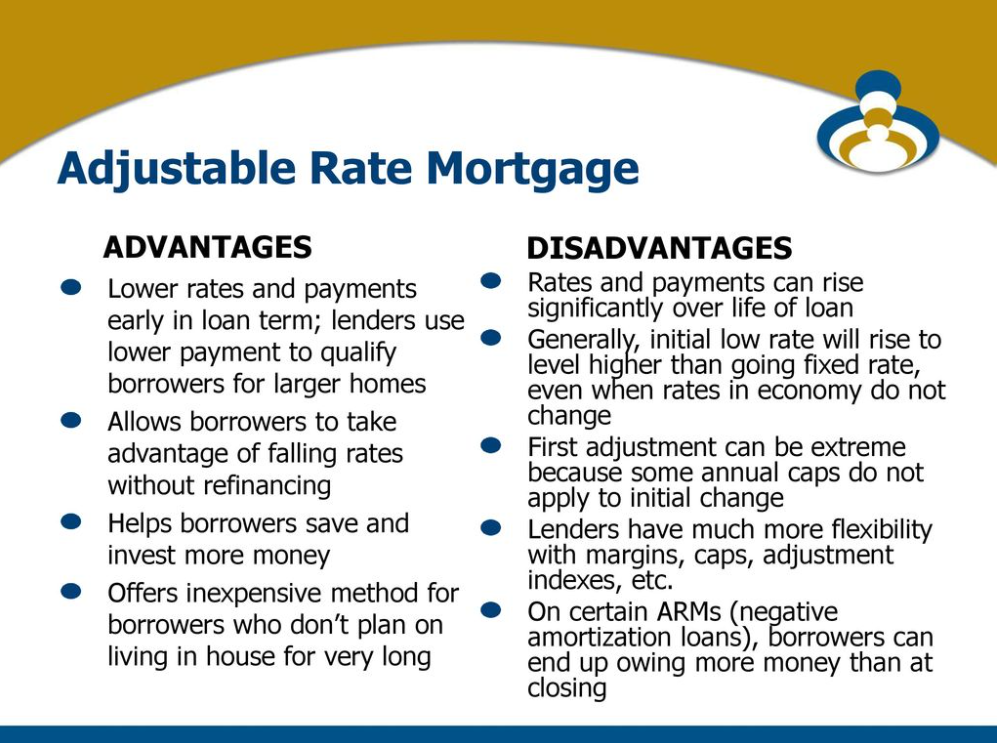

An Adjustable-Rate Mortgage (ARM) is a home loan with an interest rate that varies over time, typically starting with a lower fixed rate for an initial period—such as 5, 7, or 10 years—before adjusting periodically based on market indices. This structure can make ARMs appealing to buyers seeking lower initial payments or those planning to sell or refinance before the adjustment period begins. However, the potential for rate increases after the fixed period introduces a level of uncertainty, which borrowers should carefully consider.

In recent years, ARMs have regained popularity, especially as fixed mortgage rates have risen. For instance, in 2022, the share of mortgage applications for ARMs increased significantly, reflecting borrowers’ interest in lower initial rates. Despite this resurgence, ARMs still represent a smaller portion of the mortgage market compared to their peak in the early 2000s. Prospective borrowers should weigh the benefits of lower initial rates against the risks of future rate adjustments, considering factors like their financial stability, the length of time they plan to stay in the home, and potential rate fluctuations.

Portfolio Loans

A portfolio loan is a mortgage that a lender retains in its own investment portfolio rather than selling on the secondary market. This retention allows lenders greater flexibility in underwriting standards and loan terms, making portfolio loans particularly beneficial for borrowers with unique financial situations, such as self-employed individuals, real estate investors, or those purchasing non-traditional properties. In Seattle’s diverse real estate market, portfolio loans can provide tailored financing solutions that accommodate the city’s varied property types and buyer profiles.

Interest rates for portfolio loans typically range from 5% to 9%, depending on the lender and the borrower’s creditworthiness. As of 2023, portfolio loans account for approximately 23.7% of the mortgage market, reflecting their significance as an alternative financing option. While they offer flexibility, it’s important to note that portfolio loans may come with higher interest rates and fees compared to conventional loans. Borrowers should carefully assess their financial situation and consult with lenders to determine if a portfolio loan aligns with their homeownership goals.

Less Commonly Used Loan Types in Seattle

Some loan types, while available, are less commonly used in Seattle due to the region’s urban and high-cost housing market. These include USDA loans, hard money loans, and seller financing, which tend to cater to niche needs and specific circumstances.

- USDA Loans: Designed for rural or suburban areas, USDA loans offer zero down payment options and low interest rates for moderate-income borrowers. However, Seattle’s urban nature and high property values mean most homes don’t qualify under the program’s strict geographic and income requirements, making USDA loans rare in the area.

- Hard Money Loans: These short-term loans, typically used by investors, are secured by the property itself rather than the borrower’s creditworthiness. With higher interest rates and fees, they are less attractive for primary residences and are mainly used for flips or distressed properties, which are less common in Seattle’s competitive market.

- Seller Financing: While seller financing can be a flexible option for buyers who struggle to qualify for traditional loans, it is rarely used in Seattle because sellers in a hot market typically have multiple offers and little incentive to act as a lender.

These options are less common in Seattle because they either cater to rural markets, are tailored for specific investment purposes, or are less competitive compared to conventional financing in a high-demand market like Seattle.

Conclusion

Navigating Seattle’s diverse and competitive real estate market requires a clear understanding of the various financing options available. From traditional mortgages and jumbo loans to bridge loans, HELOCs, and niche products like portfolio loans, each option offers unique benefits and challenges depending on your financial situation and homeownership goals. While commonly used loans like conventional and jumbo loans dominate the market, specialized products like FHA, VA, and bridge loans provide essential tools for specific buyer needs.

For less commonly used loans, such as USDA loans, hard money loans, and seller financing, their limited relevance in Seattle stems from the city’s urban landscape, high property values, and competitive seller-driven market. Choosing the right loan type is critical for a successful home-buying journey. Consulting a knowledgeable lender and real estate professional can help you assess your financial options and develop a tailored strategy to achieve your goals in Seattle’s fast-paced housing market.

How Keller Williams Greater Seattle Can Help You Find the Perfect Home

At Keller Williams Greater Seattle, our agents have years of experience helping clients find their dream homes in Seattle. We understand that every client is unique, and we work with each client to understand their individual needs and preferences. Whether you are a first-time homebuyer or an experienced investor, we can help you find the perfect home.

Our agents have a deep knowledge of the local real estate market in Seattle. We stay up-to-date on market trends, home values, and new developments, so that we can provide our clients with the most accurate and up-to-date information.

We also have a wide network of lenders and mortgage brokers in Seattle. We can help you find the best financing options for your specific needs and budget. Whether you are looking for a traditional mortgage, a jumbo loan, or a bridge loan, we can connect you with the right lender.

In addition, we offer a variety of other services to help our clients throughout the home-buying process. We can help you find a home inspector, a real estate attorney, and other professionals who can assist with your home purchase. We can also help you navigate the complex process of negotiating and closing on a home.

Financing a home in Seattle can be complex, but with the right guidance and support, it doesn’t have to be overwhelming. At Keller Williams Greater Seattle, our agents have the expertise and experience to help you find the perfect home and the right financing options to make it a reality. Contact us today to learn more about how we can help you find your dream home in Seattle. (206) 578-3438