Renovate or Move? How to Decide What’s Best for Seattle Homeowners

If you’re a Seattle homeowner wondering whether to renovate or move, you’re not alone. Many families find themselves outgrowing their current home or craving a change, but deciding between upgrading your existing space and buying a new one isn’t easy. With Seattle’s real estate market remaining competitive and renovation costs on the rise, this decision has become even more challenging.

In this blog, we’ll break down the key factors to consider when deciding to renovate or move, from the financial implications to lifestyle and market trends unique to Seattle. Whether you want to create your dream home or explore a new neighborhood, this guide will provide the insights you need to make the right choice for your future. Let’s explore your options!

Renovate or Move? Homebuyer Preferences Shape Today’s Housing Trends

As homeowners debate whether to renovate or move, understanding the features that buyers prioritize can help guide the decision. The latest AIA Home Design Trends Survey for Q3 2024 highlights key preferences, from the continued demand for home offices to the rising popularity of outdoor living spaces and multi-functional rooms. These insights reveal what’s driving modern housing trends and how adapting your home could align with today’s market demands:

- Home Offices: The demand for home offices remains strong, with 24% of respondents identifying it as a popular special function room.

HDTS

- Outdoor Living Spaces: Similarly, 24% of respondents highlighted outdoor living areas as a top preference, indicating a continued desire to extend living spaces outdoors.

HDTS

- Au Pair/In-Law Suites (Junior Accessory Dwelling Units – ADUs): These spaces have gained prominence, with 15% of respondents noting their popularity, reflecting a trend towards accommodating extended family members or creating flexible living arrangements.

HDTS

- Additional Multi-Function Rooms/Flexible Spaces: 13% of respondents expressed interest in versatile rooms that can serve multiple purposes, such as home offices, children’s play areas, or guest rooms.

HDTS

- Mud Rooms: 8% of respondents indicated a preference for mud rooms, underscoring the value placed on transitional spaces that help maintain cleanliness and organization within the home.

If you’re a homeowner who wants to add any of the above, you have two options: renovate your current house or buy a home that already has the spaces you desire. The decision you make could be determined by factors like:

- A possible desire to relocate

- The difference in the cost of a renovation versus a purchase

- Finding an existing home or designing a new home that has exactly what you want (versus trying to restructure the layout of your current house)

In either case, you’ll need access to capital: the funds for the renovation or the down payment your next home would require. The great news is that the money you need probably already exists in your current home in the form of equity.

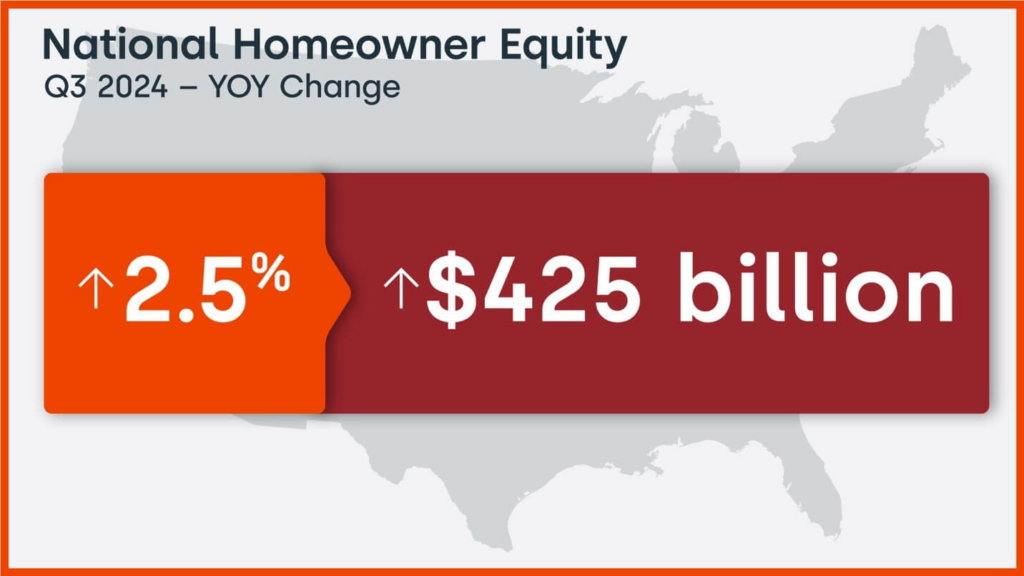

Home Equity Is Skyrocketing

The record-setting increases in home prices over the last two years dramatically improved homeowners’ equity. The graph above uses data from CoreLogic to show the average home equity gain in the first quarter of the last nine years: Odeta Kushi, Deputy Chief Economist at First American, quantifies the amount of equity homeowners gained recently:

“Remember U.S. households own nearly $35 trillion in owner-occupied real estate, just over $11 trillion in debt, and the remaining ~$24 trillion in equity. In inflation adjusted terms, homeowners in Q2 had an average of $280,000 in equity- a historic high.”

As a homeowner, the money you need to purchase the perfect home or renovate your current house may be right at your fingertips. However, waiting to make your decision may increase the cost of tapping that equity.

If you decide to renovate, you’ll need to refinance (or take out an equity loan) to access the equity. If you decide to move instead and use your equity as a down payment, you’ll still need to mortgage the remaining difference between the down payment and the cost of your next home.

Mortgage rates are forecast to increase over the next year. Waiting to leverage your equity will probably mean you’ll pay more to do so. According to the latest data from the Federal Housing Finance Agency (FHFA), almost 57% of current mortgage holders have a mortgage rate of 4% or below. If you’re one of those homeowners, you can keep your mortgage rate under 4% by doing it now. If you’re one of the 43% of homeowners with a mortgage rate over 4%, you may be able to do a cash-out refinance or buy a more expensive home without significantly increasing your monthly payment.

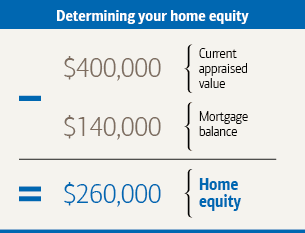

First Step: Determine the Amount of Equity in Your Home

If you’re ready to either redesign your current house or find an existing or newly constructed home that has everything you want, the first thing you need to do is determine how much equity you have in your current home. To do that, you’ll need two things:

- Current Market Value of Your Home: This can be determined through a professional appraisal or by analyzing recent sales of comparable properties in your area.

- Outstanding Mortgage Balance: This is the amount you still owe on your home loan, which can be found on your latest mortgage statement or by contacting your lender.

By subtracting your outstanding mortgage balance from your home’s current market value, you can determine your home equity. This equity can be a valuable resource, potentially serving as a down payment for a new home or funding for renovations.

To assist with this calculation, consider using online home equity calculators. These tools can help you estimate your home equity and explore potential loan options.

Understanding your home equity empowers you to make informed decisions about leveraging this asset for future real estate endeavors.

Next Step: Explore Your Options

Once you’ve determined the amount of equity in your home, the next step is to explore your options. This means evaluating whether renovating your current home or purchasing a new one is the better fit for your needs.

- If You’re Considering Renovating:

- Research the cost of the renovations you’re envisioning.

- Obtain quotes from contractors and prioritize updates that will add the most value to your home.

- Compare renovation costs with the potential increase in your home’s market value.

- If You’re Considering Moving:

- Explore the local market to see what’s available within your budget.

- Work with a trusted real estate agent to identify homes that meet your needs, whether it’s more space, a better location, or a new layout.

- Use your home equity as a down payment to make a strong offer on your next home.

Both options have their pros and cons, and understanding what works best for your family and finances is key to making the right decision. At this stage, having professional guidance can make all the difference. Whether you’re leaning toward renovating or moving, I’m here to help you weigh your options and take the next step with confidence!

Last Step: Plan and Execute Your Decision

Once you’ve decided whether to renovate or move, it’s time to put your plan into action. If you’re renovating, start by creating a clear plan for the upgrades you want—whether it’s adding a home office, remodeling the kitchen, or expanding your living space. Prioritize projects that will add value to your home and improve your lifestyle. Next, gather quotes from contractors, designers, or architects to estimate costs and timelines, and secure financing through a home equity loan, cash-out refinance, or savings. Once construction begins, stay involved to ensure everything stays on schedule and within budget.

If you’ve decided to move, the process starts with preparing your current home for sale. Declutter, clean, and stage it to showcase its best features and attract buyers. Work with a trusted real estate agent to price your home competitively and market it effectively. At the same time, begin your search for a new property that aligns with your needs, whether that means more space, a better location, or a modern layout. Use the equity from your current home as a down payment to strengthen your offer and make the transition as seamless as possible. With careful planning and decisive execution, you’ll be on your way to a home that truly meets your needs and goals.

Should You Renovate or Move? Making the Right Choice for Your Future

Deciding whether to renovate your current home or move to a new one is a big decision, and it ultimately comes down to your unique needs, lifestyle, and financial situation. If you love your location but need updated features, redesigning your home using your available equity could be the perfect solution. On the other hand, if your current home no longer meets your needs—whether due to space, layout, or neighborhood preferences—exploring a move might offer you the fresh start you’re looking for.

For Seattle homeowners, factors like rising demand for multi-generational homes, waterfront properties, or modern flexible spaces can influence this decision. The key is understanding your home’s current equity, evaluating the cost of renovations, and comparing those to the benefits of buying something new.

If you’re still unsure which path to take, I’m here to help. Reach out for a personalized consultation to discuss your options and create a plan that makes sense for you. Whether you choose to renovate or move, I’ll guide you every step of the way to ensure you make the best choice for your future! Visit HomeProAssociates.com to learn more about our services.