If you’re planning to buy a home in Seattle, your tax refund could be the financial jumpstart you need. While the Seattle housing market is known for its competitive prices and limited inventory, the good news is—every dollar counts, especially when you’re saving for a down payment, covering closing costs, or trying to make your monthly payment more affordable.

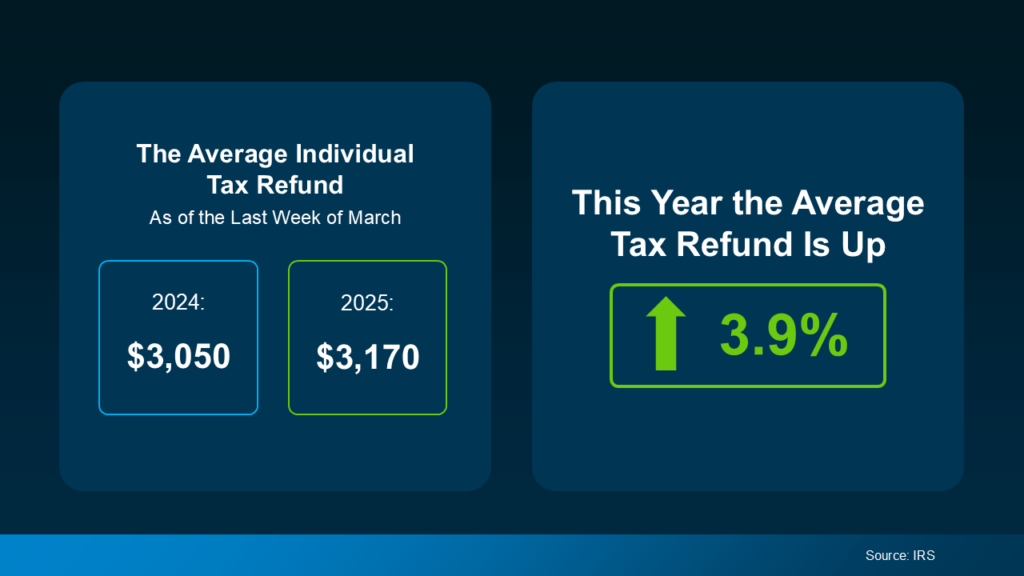

According to the IRS, the average 2025 tax refund is up 3.9% from last year, bringing it to approximately $3,028 nationwide. That might not sound like a windfall, but when it comes to buying a home, it can absolutely tip the scales in your favor—especially in a high-cost city like Seattle.

In this article, I’ll walk you through smart ways to use your tax refund to move closer to homeownership. Whether you’re a first-time buyer or simply need a little help getting across the finish line, this guide will show you how to put that money to work strategically in today’s market.

Why Your Tax Refund Matters When Saving for a Home

Buying a home in Seattle means playing in one of the most competitive real estate markets in the country. That’s why even a modest financial boost—like your tax refund—can be more powerful than you think.

According to Freddie Mac, your tax refund from the IRS can be a useful supplement to your homebuying budget. And in 2025, many buyers will have just a little more to work with. As of April, the average refund nationwide is approximately $3,028, up 3.9% from 2024’s average of $2,916.

In a high-cost market like Seattle, where the median home price is over $850,000 as of Q1 2025, these funds probably won’t cover a full down payment—but they can certainly help:

- Bridge the gap in your down payment savings

- Offset closing costs, which typically run 2–5% of the purchase price

- Buy down your interest rate, reducing long-term costs

Many first-time buyers are surprised to learn that you don’t need 20% down to purchase a home. Programs through FHA, VA, and conventional lenders often allow as little as 3–5% down, depending on your financial profile. That means a few thousand dollars from your tax refund can accelerate your timeline significantly.

In short, if you’re preparing to buy in 2025, don’t overlook your tax refund. Used strategically, it could be the push you need to start touring homes, submitting offers, and finally getting those keys in your hand.

Smart Ways To Use Your Tax Refund Toward Buying a Home

If you’re getting a tax refund this year, it’s a great opportunity to move closer to homeownership—especially in a high-cost market like Seattle. Here’s how you can strategically use that money to offset upfront costs and strengthen your financial position as a buyer.

Boost Your Down Payment Fund

The down payment is one of the most talked-about hurdles in the homebuying process. But contrary to popular belief, you don’t need 20% down to purchase a home.

- Conventional loans may allow down payments as low as 3%.

- FHA loans start at 3.5% down.

- VA and USDA loans may offer zero-down options for eligible borrowers.

For example, with a $750,000 home purchase (more in line with starter homes in Seattle), a 5% down payment is $37,500. A $3,000 tax refund might not cover all of it, but it can bridge the gap or serve as part of your earnest money or reserves.

Help Cover Closing Costs

Closing costs in Washington State typically run 2% to 5% of the purchase price. That includes expenses like:

- Appraisal fees

- Title insurance

- Escrow and legal services

- Loan origination fees

- Prepaid taxes and insurance

On a $750,000 home, that could mean an additional $15,000 to $37,500 due at closing.

Your tax refund can be used toward:

- Reducing out-of-pocket expenses at closing

- Covering lender-required prepaid items

- Funding home inspections or moving costs

Buy Down Your Mortgage Rate

With mortgage interest rates hovering around 6.5–7% in early 2025, affordability is top of mind for many Seattle buyers.

Using your tax refund to buy mortgage points (also called discount points) is one way to reduce your rate. Typically, one point costs 1% of your loan amount and can lower your interest rate by around 0.25%.

For example:

- Buying 1 point on a $600,000 loan = $6,000 upfront

- Potential monthly savings = $100–$150

- Long-term savings over 30 years = $30,000–$50,000+

Stack Your Refund with Down Payment Assistance

Washington State offers a variety of down payment assistance (DPA) programs through the Washington State Housing Finance Commission (WSHFC). Many first-time buyers combine these funds with their own savings—including tax refunds—to qualify for competitive loans and reduced upfront costs.

- Up to $10,000–$15,000 in assistance may be available depending on income and location

- Funds can be used for down payment or closing costs

- Loans are often 0% interest and deferred

Why Professional Guidance Matter

Using your tax refund wisely can definitely give you a head start toward homeownership—but figuring out how to put that money to best use isn’t always simple, especially in a competitive and high-cost market like Seattle.

That’s where working with trusted real estate and lending professionals comes in. Here’s why:

Tailored Advice Based on Your Situation

Not every buyer will benefit equally from putting their tax refund toward the same expenses.

A trusted professional can help you:

- Assess whether it’s smarter to boost your down payment or buy down your mortgage rate based on your financial goals.

- Evaluate whether you qualify for local down payment assistance programs through organizations like the Washington State Housing Finance Commission (WSHFC).

- Plan around Seattle’s higher-than-average closing costs and typical property taxes, which can impact your upfront and monthly budgets.

Example: A first-time buyer putting 3% down with PMI may benefit more from using their refund to cover closing costs upfront rather than stretching to 5% down.

Maximize Lending and Grant Opportunities

There are often specialized loan products, grant programs, or rate buy-down promotions available that buyers don’t even know exist.

A great lender will:

- Help you combine your tax refund with special financing incentives (such as lender-paid closing costs or rate locks).

- Calculate how much lower your monthly payment would be if you bought mortgage points.

- Show you side-by-side scenarios so you can choose the smartest path.

Strategy Beats Speed in a Hot Market

It’s easy to feel rushed when you have cash in hand and want to move quickly.

However, Seattle’s real estate market requires a strategic approach more than a fast one.

A strong real estate agent (like myself) will:

- Help you prioritize neighborhoods and property types that fit your long-term needs.

- Guide you through negotiations to potentially get seller concessions to reduce your closing costs further.

- Monitor market shifts so you’re ready to strike when the right opportunity comes along.

Buying a home is one of the biggest financial moves you’ll ever make. Having a professional on your side ensures your tax refund doesn’t just disappear—it becomes a key tool in achieving your dream of homeownership.

Bottom Line: Small Steps Today Bring Big Dreams Closer

Every dollar counts when you’re saving to buy a home—especially in a competitive market like Seattle.

Your tax refund might not be enough to buy a house on its own, but it can absolutely move you closer to your goal, whether that’s boosting your down payment, covering closing costs, or buying down your mortgage rate.

Buying a home is a journey that rewards preparation, smart planning, and good advice. And that’s exactly what I’m here to offer.

Ready to turn your tax refund into a smart investment in your future? Let’s make it happen together.

I’m Emily Cressey with HomePro Associates, and I specialize in helping buyers navigate the Seattle real estate market with clarity and confidence. Whether you’re ready to buy now or simply exploring your options, I’m here to guide you through the process and help you make the best financial decision for your future.

Call me at (206) 578-3438 to schedule your consultation and learn how to make today’s market work for you.

During our conversation, I’ll even provide a professional analysis of your current property’s worth—no pressure, just clear, actionable advice you can trust.

Want even more real estate tips and insider insights? Be sure to check out our YouTube channel, where I share expert guidance, Seattle market updates, and neighborhood home tours to keep you informed and empowered throughout your real estate journey.