I’m gonna go out on a limb and report that I see the Seattle Real Estate Market starting to cool down. This could represent upcoming buyer opportunities as the market comes into better balance. However, I don’t see priced declining any time soon, and here’s why…

Is The Market Softening Up?

Look what happened this week:

- I Sold a house to a buyer who attended the open house (not a multiple-offer scenario).

- I Got buyers under contract to buy a house they like (without over paying) who had been shopping (and getting out bid) for 7 months…

- I Had a meeting with other agents from my Seattle HomeSmart office who all agree the market is starting to slow down.

- I Am seeing more buyers’ agents waiting to present offers until after the seller’s offer review period has passed. (For example, after the house has been on the market for 1 week or more…)

What Does This Mean For Buyers?

This is good news for buyers. We are coming to the end of the “Spring Rush” and although it was another record-breaking month, we are seeing fewer competitive-offer situations, and the ones we ARE seeing are not AS competitive. Not as many “hail-mary” offers are being thrown out any more. For example, all four of the last four buyers I have put under contract have been able to get an inspection on their home before buying it.

Power is returning to the buyer, if you’ve been waiting on the sidelines, it’s time to come out and start looking at homes again.

What Does This Mean For Sellers?

It’s still a good time to sell, but you can’t just price the home $100K over it’s current value and expect it to fly off the shelf.

It’s going to be increasingly important for homes to be in good condition, well-marketed, and attractively-priced if the home is going to sell quickly.

Why This Is Not Like 2008 Again

During the Great Recession, just over a decade ago, the financial systems the world depended on started to collapse. It created a panic that drove some large companies out of business (ex. Lehman Brothers) and many more into bankruptcy.

The financial crisis that accompanied the current pandemic caused hardship to certain industries and hurt many small businesses. However, it hasn’t rattled the world economy. It seems that a year later, things are slowly getting back to normal for many companies.

Why is there a drastic difference between 2008 and now?

In a post from RealtyTrac, they explain:

“We changed the rules. We told banks they needed more reserves and that they could no longer underwrite toxic mortgages. It turns out that regulation — properly done — can help us navigate financial minefields.”

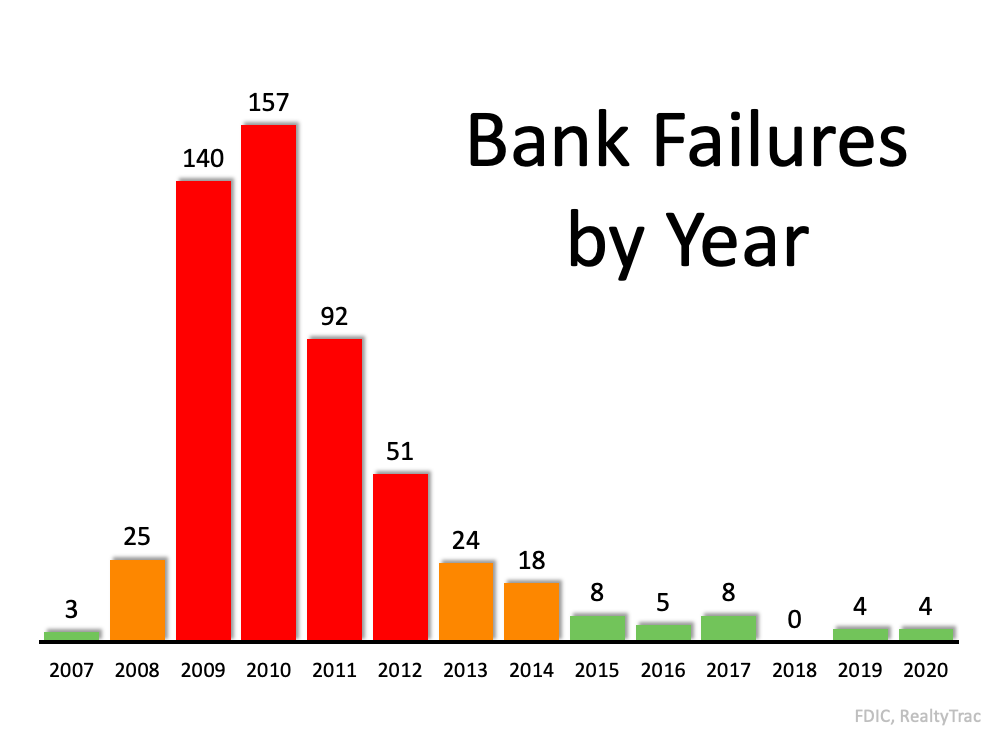

Here are the results of that regulation, captured in a graph depicting the number of failed banks since 2007.

What was different this time?

The post mentioned above explains:

“In 2008 the government saw the foreclosure meltdown as a top-down problem and set aside $700 billion for banks under the Troubled Asset Relief Program (TARP). Not all of the $700 billion was used, but the important point is that the government did not act with equal fervor to help flailing homeowners, millions of whom lost their homes to foreclosures and short sales.

This time around the government forcefully moved to help ordinary citizens. Working from the bottom-up, an estimated $5.3 trillion went to the public in 2020 through such mechanisms as the Paycheck Protection Program (PPP), expanded unemployment benefits, tax incentives, and help for local governments. So far this year we have the $1.9 billion American Rescue Plan with millions of $1,400 checks as well as proposals to spend trillions more on infrastructure…Bank deposits increased by nearly $2 trillion during the past year and credit card debt fell.”

What About The Seattle, WA Market In Particular?

I like to look at housing trends with the INFLATION factor removed. Right now we are in a big inflationary economy and just like “a rising tide raises all ships” the inflation of the money supply can make “everything” appear to be going up in value – lumber, gas, houses, etc.

When I look at housing data, I often review it with inflation removed – so we can see the true trends in housing prices over-and-above inflation.

With that set-up, looking at the Seattle market, the “big crash” of 2007 is the only time we’ve seen big losses in the Seattle housing market in the last 40 years. At that point in time, the whole country was having the same problem. Seattle saw houses go down in value 10-15% per year for five years, starting to gain value again in 2013.

Other than this market, the only time Seattle homes lost value was 1989-1996, when prices fell between 1-3% a year. This would have probably looked like a “stable” market with inflation riding on top of it.

The Point: The Seattle Market has RARELY seen significant losses in the past 40 years. It is not a big cyclical market like many of those in California. And it’s not a flat market like many of those in the mid-west. History says it’s been an appreciating market, but it did take a hit when the rest of the country did, too, in the wake of the mortgage meltdown crisis of 2006-2008.

My sister bought a downtown Ballard condo at the worst possible time – right in 2007 at the peak of the market. She was able to sell it a few years later after the market recovered, around 2015 – and she ended up making a profit on it. Actually a bigger profit than I made on a Lynnwood condo that I held over a longer time period (bought cheaper, before the run up, and sold later, after the recovery). If you are in the right location at the right time, you can weather most storms…

Bottom Line

Many have suffered over the past year. However, the economic toll of the current recession was nowhere near the scope of the Great Recession, and it won’t result in a housing crisis.