Five Myths About Credit Scores Seattle Home Buyers May Still Believe

When it comes time to buy a home in Seattle, WA, it can seem like a daunting task.

How can you get qualified for a home loan? What kind of cash and credit do you really need?

A good credit score boosts your chances of getting a mortgage because it shows lenders you know how to make your payments on time and you are likely to make your payments TO THEM on time! Eeek! Having a bad credit score can be a massive barrier towards home ownership in the Seattle, WA market – that’s for sure. This is why understanding and managing your credit score is especially important when you’re preparing to buy a house!

The good news is: You Can Improve Your Credit Score… But it may not happen the way you think or the way you’ve always been told.

Let’s discuss some of the “ins and outs” of how credit scores work. And there are quite a few harmful myths or misconceptions surrounding “the FICO” that many soon-to-be homebuyers believe, and some of them may be holding you back! Uh-oh! Let’s check!

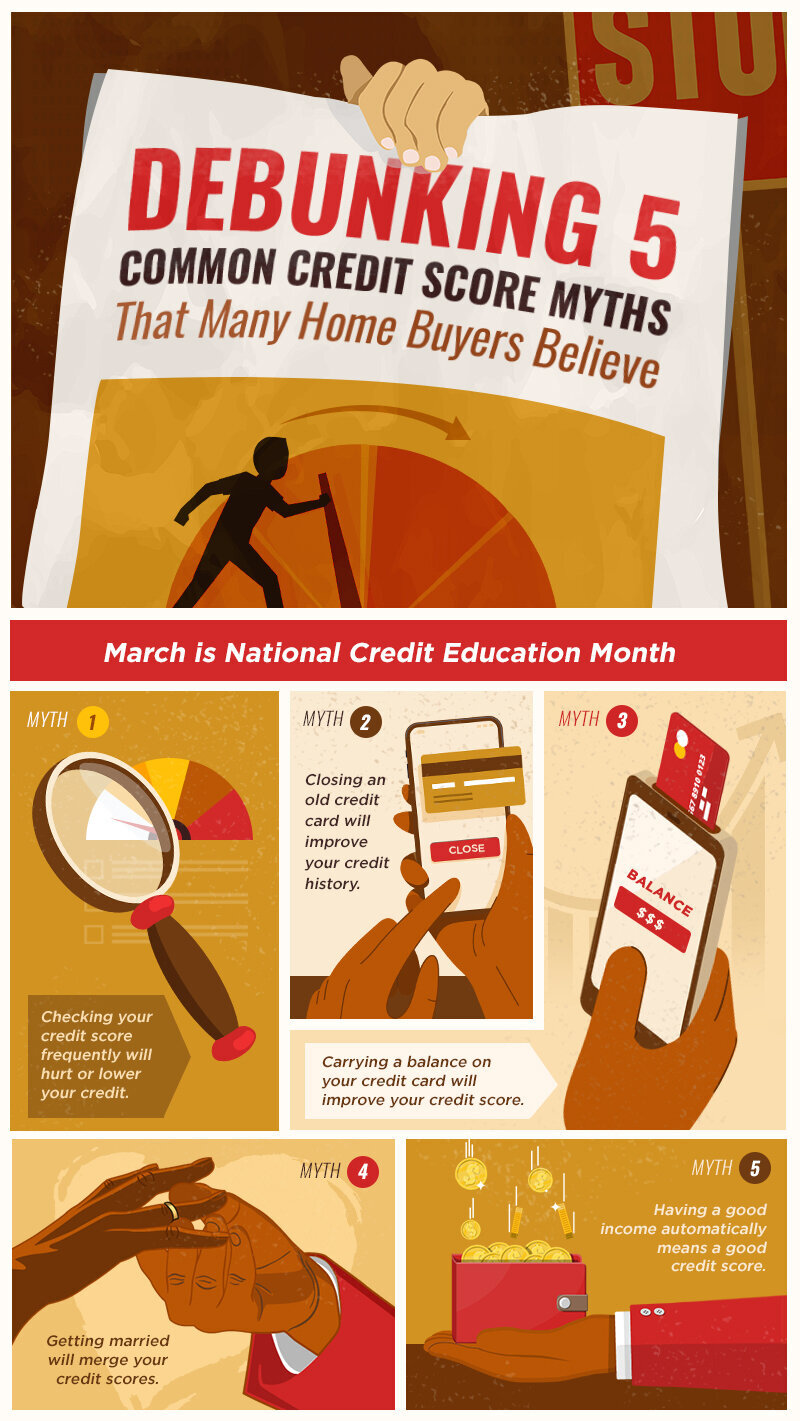

5 Common Credit Score Myths

Here we debunk some of the most common credit score myths and show you the truth once and for all. Because the worst time to find out that your credit score is going nowhere due to any misinformation is when you already set your heart towards buying a piece of the American dream.

Myth #1: Checking your credit score frequently will hurt or lower your credit.

What’s true: Only “hard” inquiries or hard checks can ding your score a few points, but not if you check on your own, which is considered a “soft” check.

Hard checks generally occur when you authorize a lender or a company to check your credit, especially if you apply for a mortgage or credit card. This kind of inquiry can have a temporary negative effect on your credit score.

On the other hand, soft inquiries don’t have any effect on your score at all. This is when you check your credit score and credit report on your own from the three major credit bureaus (Equifax, Experian, TransUnion). It is recommended that you monitor your credit score over time through routine checks to help you track your progress when building credit, and to catch any problems before they get out of hand.

You can now easily check your credit score on websites such as creditkarma.com or annualcreditreport.com, or with most card issuers. Also, due to the COVID-19 pandemic, all three credit bureaus are offering free weekly online reports through April 2021.

Myth #2: Closing an old credit card will improve your credit history.

What’s true: Closing a credit card is more likely to hurt your credit score than to improve it, especially if you close the card with a balance.

Remember that a percentage of your score comes from the length of your credit history, so if you close a card that you had for some time, your score could be adversely affected. The longer you’ve responsibly used a particular credit card, the better effect it will have on your credit score. So just leave your accounts open, especially if they’re in good standing and the card has no annual fee.

Myth #3: Carrying a balance on your credit card will improve your credit score.

What’s true: The only thing a running balance on your credit card increases is the interest you owe and certainly not your credit score. In fact, it only has the potential to lower your score and it will end up becoming a waste of money since you need to pay interest over time.

This is because any lingering balances on your account directly affect your credit card utilization rate. And the higher your credit card balance, the higher your utilization rate, which can, in turn, hurt your credit score.

Myth #4: Getting married will merge your credit scores.

What’s true: Even after you tie the knot, you and your spouse remain to be two individual entities with separate credit scores and credit histories. So just because you marry someone with a good credit doesn’t mean that your credit score will automatically improve. Likewise, marrying someone with bad credit won’t adversely affect you.

However, when you fill out a joint application for a mortgage, each of your credit scores is checked and taken into consideration by lenders. So if one of you doesn’t have a good score, it could be an issue.

Myth #5: Having a good income automatically means a good credit score.

What’s true: Your income does not directly affect your credit score. Also, it is never included on credit reports so it can’t impact your score.

FICO scores are influenced by five differently weighted factors, including payment history (35%), amount owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). Having a great job with a good salary can help you improve your finances. But your credit score is based on how you have managed credit in the past, and if you have a bad history of managing your credit, then a good income won’t help you fix that.

If you’re applying for a mortgage, lenders will assess your earnings and your credit score as two separate pieces, before approving you for a loan.

So no matter how much money you have or how much you’re earning, making on-time payments on any outstanding accounts is the best thing you can do to improve your credit score.

Where Do We Go From Here?

If you’re already working on improving your credit score, you’re on the right track. Some of our preferred lenders specialize in helping people save for a down payment & closing costs, while simultaneously improving their credit scores. It’s funny… sometimes you need to PAY OFF debt, and sometimes you need to TAKE ON MORE DEBT to raise your score. That’s why it’s hard to give one-size-fits-all advice in an article like this. If you have questions on what you should be doing to prepare to buy a house, please reach out using the form below.

How Can We Help You?

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.