Navigating the home buying process begins with understanding mortgage pre-approval, a crucial step that can significantly impact your home search and purchasing power. In this blog, we’ll delve into what mortgage pre-approval entails, why it’s essential for both first-time buyers and seasoned investors, and how it can streamline your journey to homeownership. From the benefits of getting pre-approved to the steps involved and tips for securing the best rates, we’ll provide you with a comprehensive guide to ensure you’re well-prepared for a successful home buying experience.

Mastering Mortgage Pre-approval: The Ultimate Guide

Securing a mortgage pre-approval is a crucial step in the home buying journey. It not only gives you a clear understanding of your purchasing power but also makes you a more competitive buyer in the real estate market. Whether you’re a first-time homebuyer or a seasoned investor, understanding the ins and outs of mortgage pre-approval can save you time, money, and stress.Content if any

Fun Things To Do In Seattle: Seattle Fleet Week

July may be coming to an end, but the summer in Seattle is far from over! There are still plenty of exciting activities and events to enjoy.

Parade Of Ships & Fleet Week at Seattle Waterfront

July 30 – August 4th, 2024

2024 Pier Party (Pier 62 at Waterfront Park)

July 26, 2024 5:30 – 9:00 PM

Movies At The Mural

July 26 – August 23 , Every Friday

I am SO EXCITED that FLEET WEEK is coming up. I am some sort of military geek who really enjoys going onto these naval ships and talking to the sailors about what they do. If you have kids or you enjoy history and the military, this is a STRONG RECOMMEND – to go visit the ships for fleet week.

Join me as we embrace this vibrant season in Seattle, from exploring local farmers’ markets and outdoor concerts to relaxing at waterfront parks and discovering hidden gems around the city. Let’s make the most of the sunshine and celebrate all that summer has to offer in this beautiful Pacific Northwest city!

Looking for excitement? Check out more Fun Things To Do In Seattle!

Opportunity Cost: What You Miss By Waiting For Perfection

Many of today’s home buyers in Seattle seem a little lackadaisical and slow-moving.

The Spring Rush is over, and while 70% of homes were selling in 8 days or less in April, now only 30% of homes are selling that quickly.

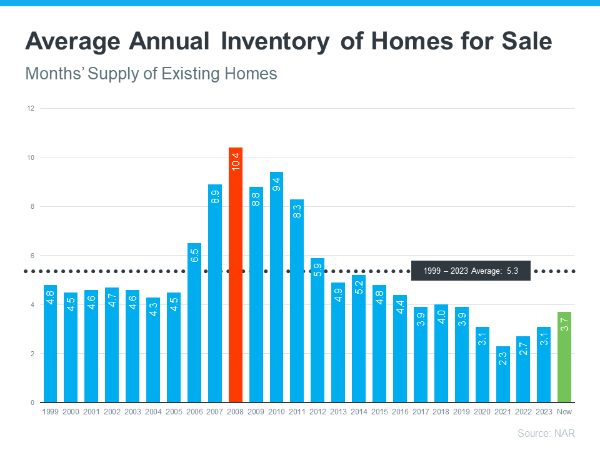

Sure, mortgage rates are a higher now than they were years ago… but we are finally starting to have more inventory and homes to choose from!

Unfortunately, many homebuyers feel like they don’t know where to start. They may have been sold the idea that they will “Find A Perfect Dream House” and that’s not really realistic, especially for first time buyers.

As Bankrate explains:

“One of the most common first-time homebuyer mistakes is looking for a home that checks each of your boxes. Looking for perfection can narrow your choices and lead you to pass over good, suitable options for starter homes in the hopes that something better will come along.”

In the journey of buying a home, patience is crucial, but waiting too long for the perfect home can delay your dream of homeownership. The truth is, the perfect home may not be in your price range, if it even exists at all!

ContentEverything in life is about compromise, and you want to find that best home that you can afford, and then move forward. Once you’ve looked at about 10 homes, you should have a good idea of the range and quality of homes in your price range and preferred neighborhood.

With the guidance of a skilled agent, you can navigate these decisions wisely, focusing on your priorities and the potential of each home, while ensuring you find a place that fits your financial plan and future goals.

Our Investment Success: Maximized Rate Buy-Downs!

Good news! Mortgage rates are going down, and there are ways you can get a lower rate, even in this more expensive interest rate environment.

Last month my husband and I bought a $300,000 investment property and our builder offered us a 5.9% interest rate, even though we were getting a non-owner-occupied loan. Rates would normally have been above 7% for us, but the seller paid extra money to the lender to buy down our rate, and made the monthly payments more affordable.

We saved about $200/month, and it cost the builder about $10,000 to buy down the rate. If we don’t sell or refinance within the first 4 years, this investment into a lower interest rate will have paid off.

If you want to keep your house payments lower, you can ask your seller to do the same thing. If you have room to negotiate on the property you’re buying, instead of a price reduction, you can ask for an interest rate “buy down” – this will help you keep your monthly payments lower.

Alternatively, you can buy-down the rate yourself to make the home something you can afford comfortably for the long term.

For every 100,000 you borrow, a 1% difference in mortgage will save you about $65 per month… Whether saving that money makes a significant difference to you will depend on your particular situation, so let’s run the numbers together and see what the best opportunities are for you this year.

Missed our newsletter? Read our past issues here

Join Us For Weekly Real Estate Updates

The Puget Sound Market Update with Emily Cressey shares market insights and tips for buyers and sellers in the always evolving Seattle – Bellevue – Everett real estate market. Whether you want to buy, sell, or invest, our market insights will help you track market trends and make smart decisions.