How Much Cash Do You Need To Buy A Home?

Buying a home requires more than just a down payment—there are several costs to consider when planning how much cash you’ll need. In Seattle’s competitive market, understanding these financial requirements can make a big difference. While the standard down payment is often 20%, options like FHA loans allow for as little as 3.5% down. On top of that, you’ll need cash for closing costs, which typically range from 2% to 5% of the home’s price, as well as reserves for inspections, appraisals, and moving expenses.

The Final Stretch:

How To Handle Closing Day

What Happens When? Navigating closing deadlines is critical in the real estate industry, impacting both buyers and sellers alike. Whether you’re a seasoned agent or a first-time homebuyer, understanding these expectations can make all the difference in achieving successful closings.

Fun Things To Do In Seattle:

Out and About: Lake Union Ferry Boat Fun!

My co-worker, Johanna, and I recently explored NORTH Lake Union (Near Gas Works Park) at an office event on the MV Skansonia – a 1920’s Ferry Boat that is docked near the Aurora Bridge. Great views of the water and downtown Seattle! This would be an amazing wedding venue!

Fun Things To Do In Seattle:

Seahawks Home Game

UW Farm Harvest Dinner

September 19, 2024

Seahawks Home Game

September 22, 2024

Titanish

September 22, 2024

Subscribe now to stay updated on the latest fun things to do in Seattle and never miss out on exciting local events and activities!

What To Know About Closing Costs:

A Real Estate Breakdown

Closing costs are an essential part of any real estate transaction, whether you’re buying or selling a home. These fees, which can vary depending on the location, property type, and loan structure, can often catch buyers and sellers off-guard if they’re not fully prepared.

Understanding what’s included in closing costs, who is responsible for paying them, and how they affect the overall transaction can make a big difference in your financial planning.

“Closing costs vary greatly depending on your location and the price of your home. Typically, you should be prepared to pay between 2% and 5% of the home purchase price in closing fees.”

With that in mind, here’s how you can get an idea of what you’ll need to budget. Let’s say you find a home you want to purchase at today’s median price of $800,000. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $16,000 and $40,000.

I rarely see the costs go this high. In our pricey Seattle market, 2% is a better placeholder figure.

Seller-Paid Closing Costs Made

A Stress-Free Closing Day

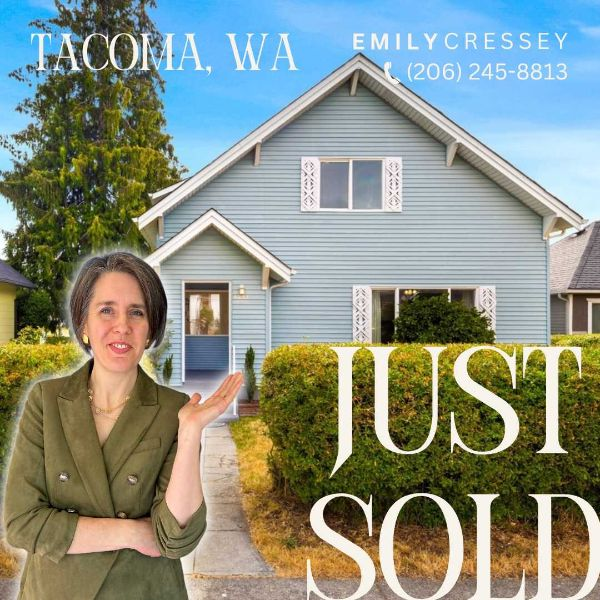

Wow! Congrats to my buyer, Shalom, who just bought this affordable Tacoma home, oozing with charm, and in a super-cute neighborhood.

She had been looking for a single-family property that would accomodate her dog and landscaping goals, and we found it!

We are thankful for a seller who was willing to negotiate to reduce the price and cover her closing costs to help offset the cost of a few maintenance items around the home.

If you’re worried about coming up with enough cash to cover YOUR closing costs, we can often ask the seller to take care of those for you, to reduce the cash you need to come up with out of pocket. As long as you can afford monthly payments, there are many down-payment assistance programs, and ways we can negotiate to reduce your up-front cash needs.

Missed our newsletter? Read our past issues here

Join Us For Weekly Real Estate Updates

The Puget Sound Market Update with Emily Cressey shares market insights and tips for buyers and sellers in the always evolving Seattle – Bellevue – Everett real estate market. Whether you want to buy, sell, or invest, our market insights will help you track market trends and make smart decisions.