Is Home Affordability Making A Comeback?

In the ever-competitive Seattle real estate market, the question of home affordability has been on everyone’s mind. After years of skyrocketing prices, limited inventory, and intense competition, some home buyers are starting to wonder: Is now the time to get back into the market? With subtle shifts in interest rates, evolving buyer demand, and a cooling market, 2024 could present opportunities for those looking to purchase in the Seattle area. Let’s explore the trends and what they mean for home buyers today.

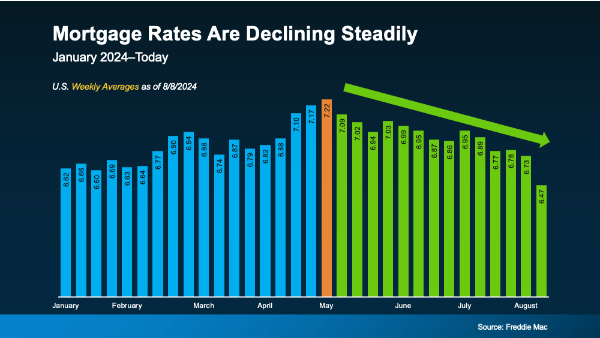

Interest Rates Are Dropping: Is Now The Right Time To Buy?

Home buyers can expect more homes for sale from now through the end of October. If you got burned-out looking at homes for sale last year, or earlier this Spring, now may be the time to resume the search!

More selection and less competition makes Fall a great time to go house hunting!

I have four buyers actively looking at homes and making offers right now. If you’ve been thinking about listing, it’s a good time to take action.

Fun Things To Do In Seattle: Summer Food Walks 2024

Chinatown/ International District Summer Food Walks

August 17, 2024 11:00 AM – 4:00 PM

Ben and I took the kids downtown on the light rail to experience this last month. We had a great time checking out Uwajimaia Asian Market, watching drummers and finding dragons. Now it’s your turn!

Celebrate Shoreline Festival

August 17, 2024 Noon – 9:00 PM

Come to this annual free, family-friendly celebration including live music, ponies, “biergarten” and children’s theater performances.

Outside The Brick

August 24, 2024 1:00 PM – 4:00 PM It’s lego day for all ages at the MOHAI Museum in South Lake Union.

August is in full swing, and Seattle is still brimming with vibrant summer energy! The city offers a wealth of exciting activities and events to dive into as the season continues.

Looking for excitement? Check out more Fun Things To Do In Seattle!

Home Affordability Update: Signs Of Improvement

Over the past couple of years, buying a home has been challenging for many. While affordability remains tight, there are positive signs we’re moving in the right direction.

Key factors impacting affordability include:

Mortgage Rates: Rates have trended down since May. Rates might keep dropping, making homes a bit more affordable.

Home Prices: Home prices are still rising, but the pace has slowed. Slower price growth could make homeownership feel more attainable.

Wages: Rising wages are helping ease affordability. Increased income means a smaller percentage of your paycheck goes toward your mortgage.

Overall, these trends suggest a gradual improvement in home affordability. For a deeper dive into how these factors affect your home-buying journey, read my full article here.

Affordable Living in Seattle:

Our Best Home Deals!

Getting your foot in the door to the Seattle real estate market doesn’t always involve a house. You can buy a condominium for closer to $300,000 and start building equity sooner than you might have thought.

That’s what my recent clients Kyle, John and Yoshi did.

If you have $400K to spend, you might be able to find a townhouse in South Seattle, or a house further out of town – maybe Sequim or Tacoma.

That’s how Debra, Deborah, and Shalom found their homes.

If you’re really low on funds, a manufactured home can provide stability and affordability. Homes can cost $100K – $200K, but you’ll have to pay lot rent on top of that… watch out! Lot rent can go up fast ($1000-$1500/month is common) and this type of housing doesn’t always appreciate over time.

This is the type of arrangement that clients Frankie, Jim and Thom have been looking for.

Buying a home is a great way to turn one of your biggest expenses – your rent – into a payment that will help you build equity in your future. Americans still rate owning real estate as the number one way to build wealth, and the biggest part of the American Dream.

And I’m here to help!

Missed our newsletter? Read our past issues here

Join Us For Weekly Real Estate Updates

The Puget Sound Market Update with Emily Cressey shares market insights and tips for buyers and sellers in the always evolving Seattle – Bellevue – Everett real estate market. Whether you want to buy, sell, or invest, our market insights will help you track market trends and make smart decisions.