So, what does the rest of the year hold for the housing market?

Here’s what experts have to say.

Inventory Increases: The Number of Homes Available For Sale Will Go Up

There are early signs housing inventory is starting to grow and experts say that should continue in the months ahead. We are still in a strong seller’s market here in the Seattle area, but we can expect to see more inventory become available in the months ahead, giving buyers an easier time to find and negotiate on a home. Expect to see a return of negotiating for buyer protections, like Home-Sale Contingencies and Pre-Purchase Inspections.

As a buyer, having more options is welcome news. Just remember, housing supply is still low, so be ready to act fast and put in your best offer up front.

As a seller, your house may soon face more competition when other sellers list their homes. But the good news is, if you’re also buying your next home, having more options to choose from should make that move-up process easier.

Interest Rates Will Keep Going Up, But Don’t Panic

As long as we’re seeing strong inflation in the economy, we can expect interest rates to keep increasing. However, it shouldn’t climb by as much as it has been. No one wants to tank the economy via the process of slowing inflation.

Experts agree inflation should continue to drive up mortgage rates up, albeit more moderately. Odeta Kushi, Deputy Chief Economist at First American, says:

“… ongoing inflationary pressure remains likely to push mortgage rates even higher in the months to come.”

As a buyer, work with trusted real estate professionals, including your lender, so you can learn how rising mortgage rate environments impact your purchasing power. It may make sense to buy now before it costs more to do so, if you’re ready.

As a seller, rising mortgage rates are motivating some homeowners to make a move up sooner rather than later. If you’re planning to buy your next home, talk to a trusted real estate advisor to decide how to time your move.

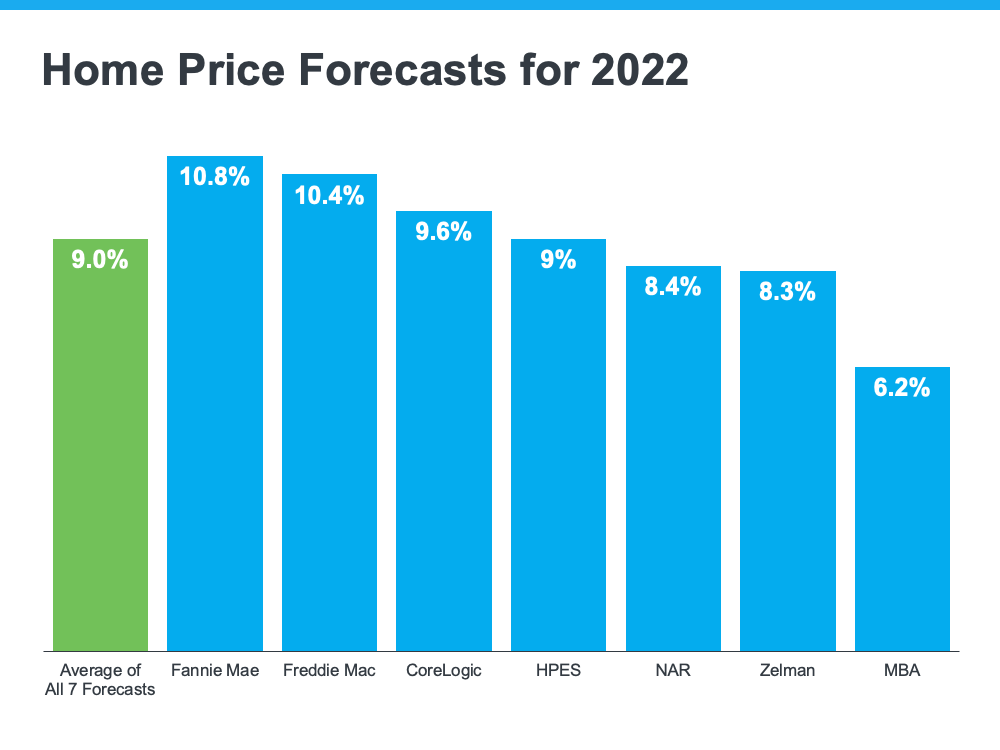

Home Prices Will Go Up, But Won’t Continue Their Crazy Climb A’ La 2021

Home prices are forecast to keep appreciating because there are still fewer homes for sale than there are buyers in the market. Supply and Demand. We have low supply and high demand. That hasn’t changed.

That said, experts agree the pace of that appreciation should moderate – but home prices won’t fall. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Prices throughout the country have surged for the better part of two years, including in the first quarter of 2022. . . Given the extremely low inventory, we’re unlikely to see price declines, but appreciation should slow in the coming months.”

As a buyer, continued home price appreciation means it’ll cost you more to buy the longer you wait. But it also gives you peace of mind that, once you do buy a home, it will likely grow in value. That makes it historically a good investment and a strong hedge against inflation.

As a seller, price appreciation is great news for the value of your home. Again, lean on a professional to strike the right balance of the best conditions possible for both selling your house and buying your next one.

Remember This

Whether you’re a homebuyer or seller, you need to know what’s happening in the housing market, so you can make the most informed decision possible. Let’s connect to discuss your goals and what lies ahead, so you can pick your best time to make a move.