Are these days of remote work and quarantining making you think about buying a retirement home? Maybe you long for the days when you could throw in the towel, kiss your boss good-bye and head for the lake, mountains or beach. Or maybe you’re just looking for a second home location to be closer to the grandkids.

As a homeowner in the Seattle, WA area, you may have been one of the thousands who have benefited from the tremendous appreciation of home values in this area over time. In fact, according to Zillow, King County has seen an average growth rate of over 8% per year in housing values in the last decade.

Know Your Numbers: How Much Equity Do You Really Have?

Unless you have refinanced or used a HELOC to pull out your equity. You may be sitting on a large nest egg in the form of Home Equity. Many home owners are surprised by the value of their home today.

Determining your financial position will help you decide if you want to have your house payment in retirement go up, down, or stay the same. It’s good to know how much money you have available for housing when looking at buying a retirement home.

Should You Buy a Retirement Home Sooner Rather Than Later?

Every day in the U.S., roughly 10,000 people turn 65. Prior to the health crisis that swept the nation in 2020, most people had to wait until they retired to make a move to the beach, the golf course, or the senior living community they were looking to settle into for their later years in life. This year, however, the game changed. Many people are considering buying a retirement home NOW!

Many employers have allowed their workers to work from home now, and perhaps indefinitely, creating a tremendous amount of location flexibility, not before enjoyed by traditional office workers. Working remotely has become increasingly feasible and desirable. Finding a place to live and work that is both affordable and beautiful has become a very real possibility for many

Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

Why These Homeowners Are Making Moves Now

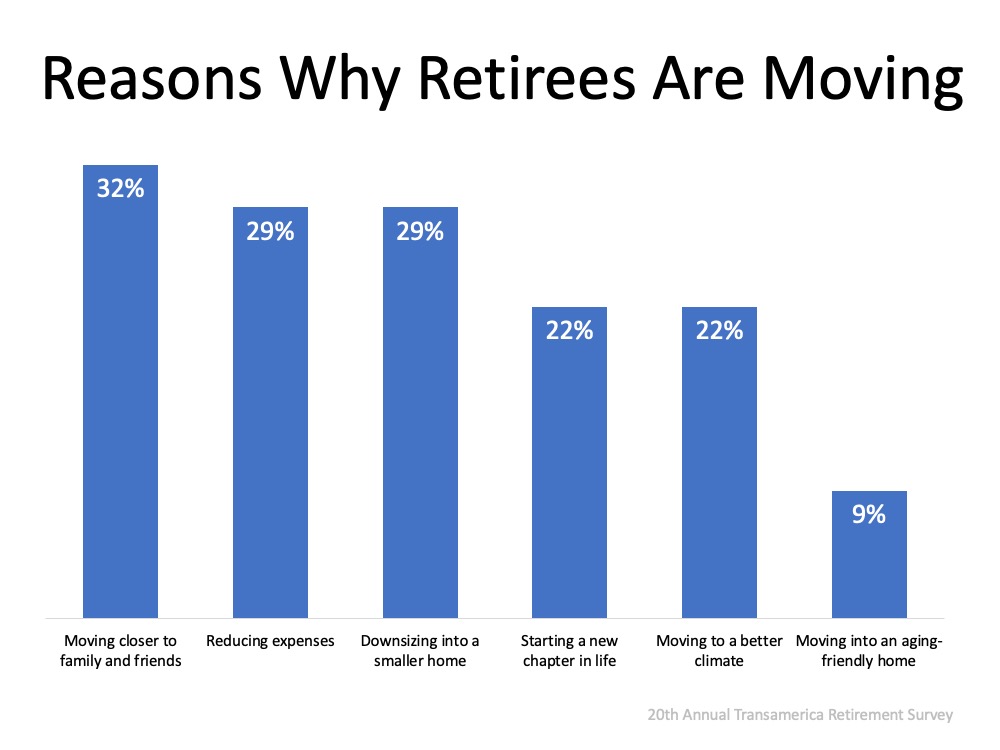

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below):The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – potentially in just a month or two.

Remember This When Considering Your Retirement Home Location

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, Seattle’s strong housing market may very well work in your favor. Working with a real estate agent who can help you sell your home locally, here in King or Snohomish County – and help you find a professional in your next “dream location” where you are thinking about buying a retirement home – is only a click away.

Fill out the form below and let’s connect today to discuss your options to sell your home in Seattle, or hold on to it and buy your retirement home and keep it as a second home or rental, even if you’re not yet ready to retire.

Remember, we at HomePro Associates are here to educate and inform you so you have the information you need to make smart decisions when buying a retirement home. We can help ever step of the way because we are here to serve!